New research reveals $111 billion opportunity for life insurance

Digital disruption is continuing to make waves in the world of life insurance. In some instances, it is driving up costs while suppressing growth and profits. But in every change there is opportunity. Life insurers that respond effectively to the shifting marketplace will ensure their survival and prosperity far into the future. Such insurers are likely to be the exception rather than the rule.

Industry surveys, including those commissioned by Accenture, find that a majority of insurance leaders do not think their industry will escape disruption. Yet those same leaders also concede that the industry has been slow to change and adopt a proactive stance to the coming disruption.

Industry surveys, including those commissioned by Accenture, find that a majority of insurance leaders do not think their industry will escape disruption. Yet those same leaders also concede that the industry has been slow to change and adopt a proactive stance to the coming disruption.

What might the cost of that inaction be?

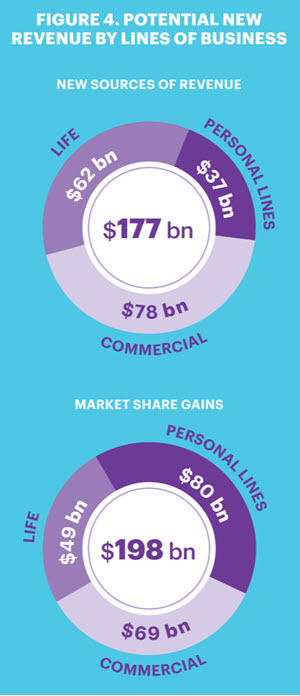

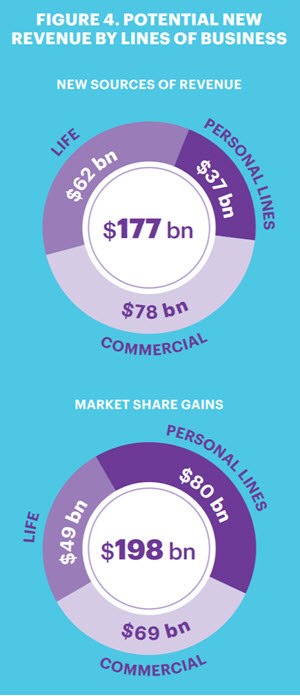

Recent research from Accenture suggests it could be $375 billion for the insurance industry as a whole and $111 billion for life insurers.

Those figures are the result of an intensive market scan of nine major economies conducted by an international team of insurance analysts and market experts. Accenture’s research team looked at the UK, the US, France, Germany, Italy, Spain, Japan, China and Australia and identified 23 digital levers of future growth for insurance. The team bundled those levers into five categories and used a common methodology, including a range of scenarios and client input, to quantify the market opportunities available to insurers that embrace digital innovation.

As the figure to the right illustrates, roughly half of this market opportunity arises from entirely new sources of revenue. The other half comes from market share gains—that is, it will come at the expense of other insurers.

The future will belong to firms that can take advantage of this windfall. Who will they be? Accenture calls them living businesses.

A living business has unwavering focus on its customers, fluid business models, and flexible platforms for talent. It prioritizes customers over products. It can move more quickly than a conventional business. It is constantly adapting to better fit its changing environment—just like a living organism.

Accenture has identified five key characteristics of living businesses. They are:

1. Engaging. This means providing timely, useful products and services to customers on their own terms—in other words, a business’ ability to “be there” for the people and organizations it serves. Engaging businesses are trusted, empathetic, and relevant allies for their customers. They are looking ahead on behalf of customers.

2. Intelligently personalized. Living businesses create hyper-relevant, context-matched offerings at scale. That means using big data to understand and anticipate the needs of individual customers.

3. Credible. Many financial service providers, including insurers, have a trust deficit they need to address. Living businesses seize every opportunity to demonstrate their genuine commitment to the customer—in every moment, across every channel, in every link of the value chain. That means taking feedback to heart, playing a role in social conversations, and helping employees live the brand.

4. Consistent. Living businesses deliver the same high-quality experience across all channels, markets and devices. They choose ecosystem partners who can do the same.

5. Generous. Living businesses are seen as allies by their customers. A reputation for being fast to accept premiums and slow to pay claims will make achieving such a reputation hard. Living businesses know when to be generous and even offer services at no cost. They strive to avoid an “us versus them” mentality.

Clearly, becoming a living business is a lofty challenge. Though some insurers have made real strides towards a digital transformation, few, if any, could truly be called living businesses right now.

Yet the billion-dollar market opportunities open to living businesses mean this will soon change. Beyond the dollar figure, what does this opportunity look like for life insurers?

We’ll explore that question in my next post. In the meantime, you can read Accenture’s research into living businesses here, where you’ll also find an interactive calculator to estimate the size of the opportunity available to your organization.