When it comes to Infinite Banking, or high cash value life insurance, a common question is how policy loans work. In this video I discuss why it makes sense to …

When it comes to Infinite Banking, or high cash value life insurance, a common question is how policy loans work. In this video I discuss why it makes sense to …

lol horrible?

A word for thought?

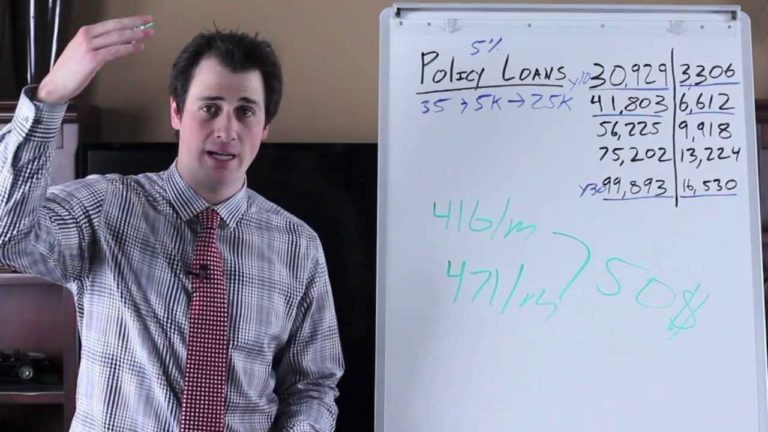

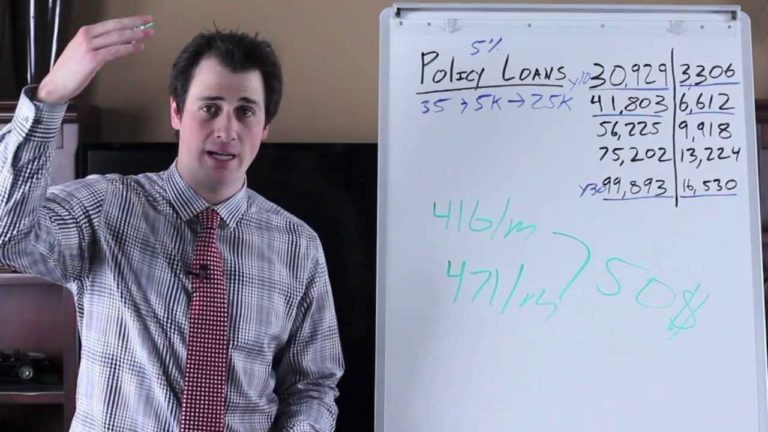

I'm a little bit confused the interest that he pays is that every year he pays that amount of interest or is that every five years that's his interest bill. So the first interest bill is the $3000 bill the next interest bill is 6000 the next interest bill is 9000 … is it to pay that every year is he paying that every five years I'm just a little bit confused.

In essence he is paying only the interest?? in other words he borrows the 25,000 against his policy every five years to get himself into a new car and pays the interest only each year? And my understanding that correctly….

If I understand correctly both guys are saving $25,000 every five years one guy gives it to the auto insurance company the other guy the smart one presumably hands it to his life insurance company and borrows against it do I have this correct.?

His interest bill every five years doubles and triples and so on because he owes interest for each $25,000 loan he will be taking out over the years…. but obviously his life insurance portion has gone up to nearly 100,000. If that's not the case then I completely don't understand this video…. help.?

Could you do this with a student loan?? treat it like purchasing a car???

This is only a half truth. Yes, the company managing the life policy pays a dividend, averaging 4-6% interest. The historical average rate of return on investment in the market is 10-12%. You, the consumer, gives part of your premuim as a "savings". The company invests your money in the global economy and makes a return. Now, when the consumer takes a loan on their own savings, you pay an interest rate. That interest money is not paid back to your "savings", it goes to the company as profit. It is the same as giving someone $100 to save your money. You want $50 of your money to pay for something, but in order to do that, the person who has your money says that it will cost you $75 of your money.

So the question becomes why pay interest on your own money that you dont get??

Rather than waste time and money dealing with an insurance company, just take out a margin loan on a basket of blue-chip dividend paying stocks. Same principle, better outcome!?

This is not a fair comparison. The person with the LI policy has already paid a lot of money into the policy and is in a financially superior position to the person who is saving from scratch. Of course the LI person is going to come out ahead.?

I didn't really follow the video. From age 35 to age 40 he is saving 5k a year vs with a life insurance policy he pays $5k into the policy? He starts at age 35 and take out the loan at age 40 for 25k? You expect 100% cash value in 5 years? A more common scenario is taking a loan from the bank for the cars value.?