In my 10 years of being a licensed driver, I have never made an insurance claim. I realized I was throwing money away.

In my 10 years of being a licensed driver, I have never made an insurance claim. I realized I was throwing money away.

The value of the car will go down as it ages so you will not be saving 1800 per year. Only the first year then less and less and depending on your driving record. If the car was finance you need full coverage anyways.

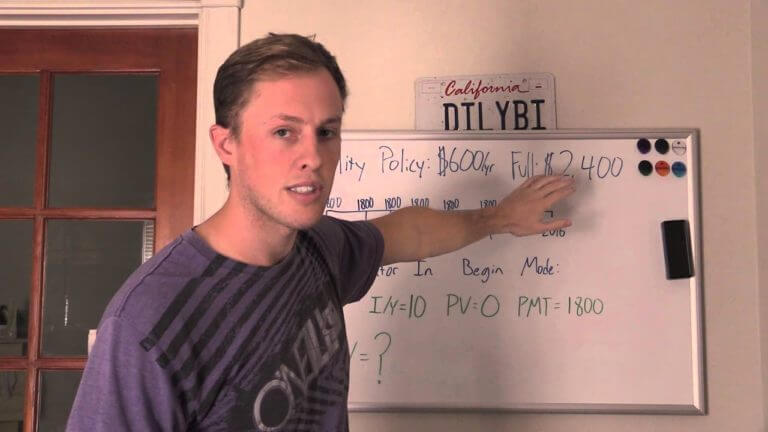

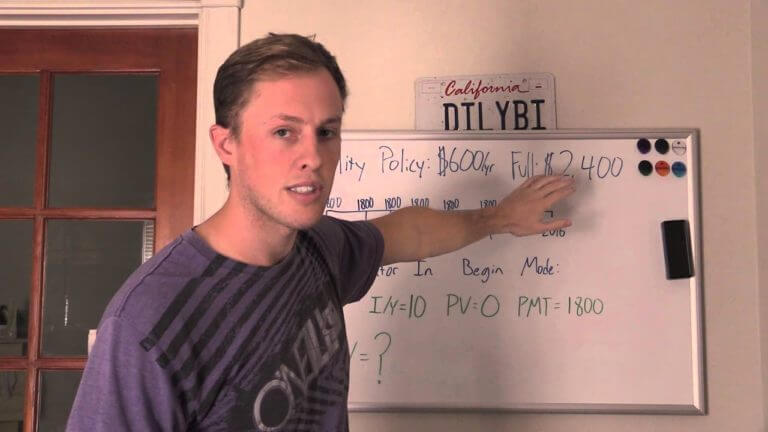

When you look at this figure, what you should take away is "Holy Cow, there are numbers written right there!"

Full coverage is only $20/mth more for my vehicle. Over ten years with a 7% return that's around $3120. Not saving much.

$600 bucks liability lmao.. i paid $5300 per year liability for a 2007 civic si in toronto… ps the civic costs $6000

I will recommend getting the comprehensive coverage since you own a CR and if you use it on the street. Who knows crazy people might steal that hardtop. Comprehensive covers theft, vandalism, glass, natural disaster, etc… I agree with you that a responsible drive don't need collision

If you cannot afford to lose your car, carry comprehensive and collision coverage. There are way too many uninsured and underinsured drivers on the road. I'm a licensed Insurance agent and take claims for home and auto. I know what happens on the other side of this formula. The key component of liability insurance absolutely IS the protection of your assets. But should be enough to avoid the loss of future earnings, too, because judgments from lawsuits don't just go away because your limit was reached. Check your state laws about liability suits that can happen when you don't carry enough Insurance. The biggest misconception here is that being a responsible driver will keep you from causing a costly accident. Weather, mechanical failure, sudden health events, momentary distractions all conspire to upset your responsible driving habits and can result in bodily injury and property damage that go beyond your liability coverage.

Your collision coverage protects your vehicle from loss regardless of fault. If the other driver provides you misinformation in order to avoid a claim (which happens more than you think) or flees the scene, it falls to your insurance to pay for your loss. Insurance is expensive for a lot of reasons. The cheaper the insurance, the greater the coverage and service sacrifice. If you aren't like this guy and have hundreds of thousands of dollars to drop on cars anytime you want, protect the one you have. Nobody likes paying for something intangible. I get it. But I never like having a conversation with an insured who was hit by someone whose policy was either inadequate or inactive on the date of loss and that their thrifty mindset that cut comprehensive and collision coverage has left them with a pile of junk in their driveway, no rental reimbursement and no recourse.

Read your policy jacket. Don't assume your insurance pays for anything unless it's covered there. Pay particular attention to exclusions. In most cases, for instance, there is no coverage for contents. If your laptop was in your car when it it was stolen, it will probably not be covered (if we're having this conversation, you're not paying the companies and policies that provide this kind of coverage — the Save 15% policies definitely don't) that's a rental or homeowners policy claim and SUBJECT TO YOUR DEDUCTIBLES. If you carry a $1000 deductible on your HO policy and your depreciated laptop value is $1000, you just caught an out of pocket expense. Think of insurance not as an investment with no return, but a massive savings account that you can only dip into under certain circumstances. Like when you, Mr. Responsible driver, make a left turn at night in the rain and don't expect the pedestrian you don't see walking in the crosswalk….

The greater your assets, the greater your exposure. But the greater your vulnerability, the tighter your finances, the more important good coverage becomes. Insurance should be considered part of the cost of driving. You spent money on your car. Spend money to protect it and you from loss.

Is it worth without it for a rebuilt car?

Keep in mind, if you owe on the car, you must keep full coverage.

Here is a rude awakening liability covers the other drivers vehicle not yours.

0:59 "I don't need to get collision coverage because I'm not going to crash my car"

That's what I thought too. 11 years driving every day with no accident. One day going to work on I-95 someone was cut off and instead of hitting his brakes they jerked their car to the left. I was beside them and they slammed me into the wall, my car then hit the curved side rail which ricocheted me back across all 4 lanes as I my car flipped on it's side.

My car was totaled. I still had 5500 to pay on the load and it was valued at 8k. My $500 deductible is why I was able to get that $8k and pay off that loan and get a new car.

I'm a great driver but I have no say in what others around you do or how they act.

Liability if one can afford to pay off a new car or payoff existing loan or lease. So this is subjective it depends on persons savings for rainy scenarios.

you are good

Insurance Corporation of British Columbia is CURVA MAFIA

Not if your shit gets stolen the first year… s2000 yeah.

Do risk analysis, first measure the cost difference then do the math and see if it is worth it versus the cost and headache of a potential accident. All insurance is is risk management. Do the math and decide for yourself if it’s worth it.

The song makes it fun

question. could i skip the collision and compreh on my insurance even my car still in finance? we have 2 cars and paying 160/month.

You confused the shiet out of me!!!!

I just found out AAA forces comprehensive if you want collision. No one needs comprehensive if they aren't driving an expensive car. Collision is useful because you can get rear ended or bot at falut or somethjng stupid. Even the best drivers eventually get into some sort of accident. But comprehensive is for vandalism and theft and things that happen to nicer more valuable cars.

In no way am I hating but I am just curious, are you still living with your parents? Great videos by the way.