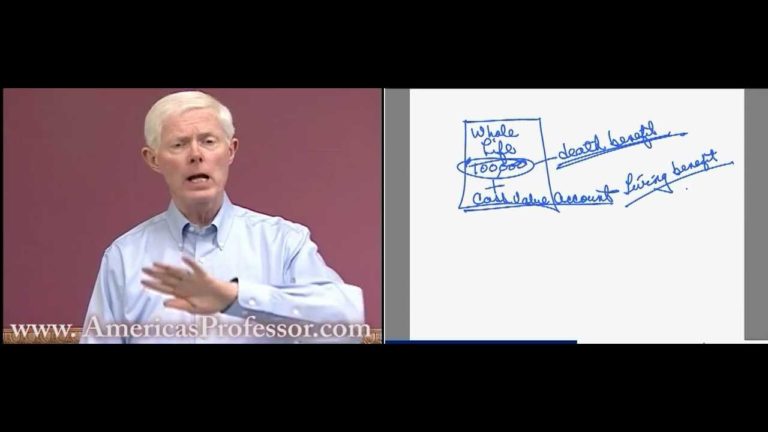

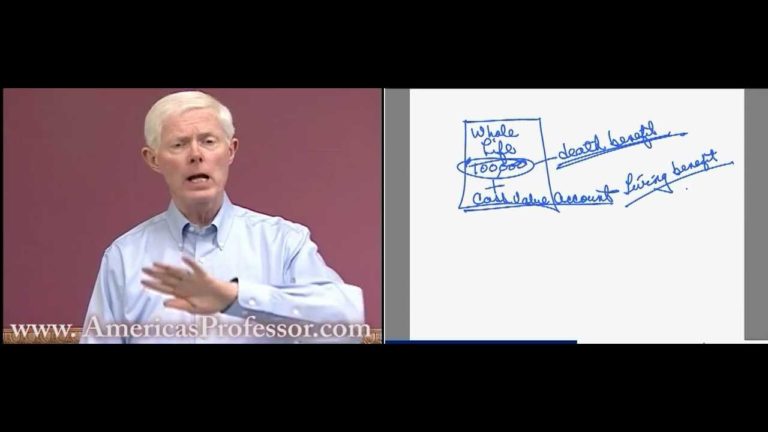

Professor Jack Morton explains what a Whole Life Policy is on the Life & Health insurance licensing exam.

Professor Jack Morton explains what a Whole Life Policy is on the Life & Health insurance licensing exam.

doesnt make any sense paying for two things your whole life but only benfiting off of 1 once the primary passes away. worst investment ever made and offered for the consumer.?

how can anybody live selling this trash value life insurance?

I wish you made "explained" videos on Variable, Term, Universal, and Variable Universal… Damn… :/?

Only helpful insurance video I have found that actually gets through to me. Thank you.?

Profesor. In a whole policy? the beneficiaries get the cash value and the face amount??

Whole life insurance is a great choice for people who want the security of a policy that never expires coupled with an investment vehicle suitable for reaching / managing financial goals.

http://www.lifeinsurancerates.com?

Very interesting.?

finally found someone on the internet that can teach simply!… thank you! please make move videos:)?

Very nice video. Direct and to the point. Thank you.

The cash value of the whole life policy is borrowed from the insurance company and if it's not repaid, then the insurance company will subtract that amount from the face value of the policy in the event of insureds death. The insurance company maintains control of the cash value account until the policy is surrendered or the death benefit is paid.

this explained a lot thank you