Life insurance can cover anything and everything depending on how much of a policy you purchase. It’s not like health insurance, which might cover certain procedures with or without a co-pay or only cover health care after you meet your deductible.

Term life insurance coverage is all or nothing. If you pass away before the term length is up, your beneficiaries will collect a policy payout in its entirety, which they can use to pay any number of day-to-day expenses, household bills or long-term costs they want. If you live beyond the length of your policy’s term, your family won’t collect a payout, but they’ll still have you.

Here are some of the most common expenses life insurance is used for:

Daily Living Expenses

While you’re alive, you’ve got an array of bills to pay for. You might be forking over $1,000 or more in rent, plus paying utility bills, pet insurance, grocery bills, extracurricular activities for the kids, school expenses and more. If you should happen to pass away, your life insurance proceeds can be used to pay for these expenses so your family can carry on with a comfortable standard of living even after you’re gone.

Mortgage or Other Significant Debts

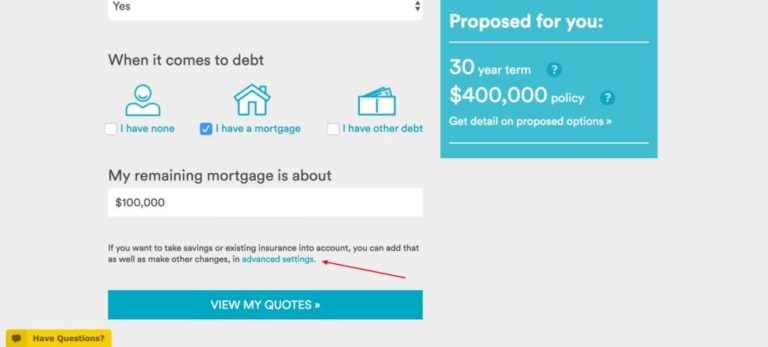

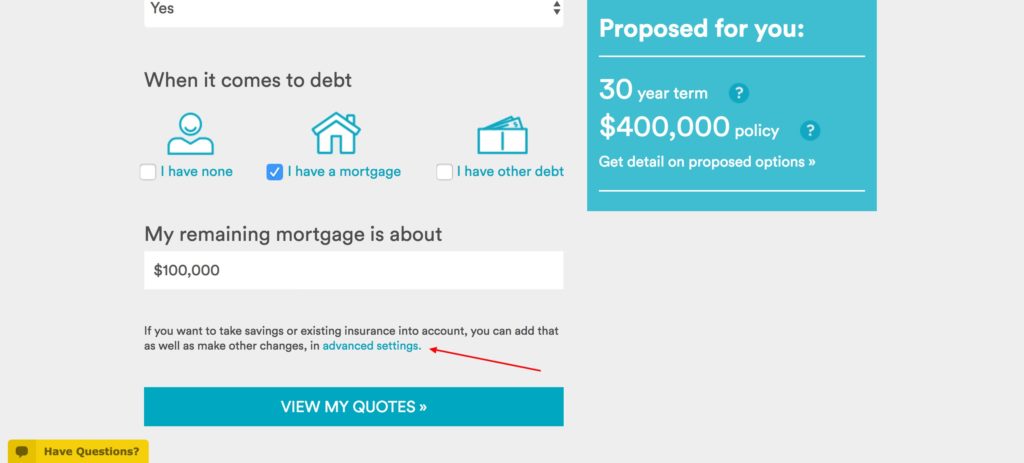

63.5% of Americans own a home, which means that a significant portion of those people probably have a mortgage. When deciding how much life insurance you need, it’s important to consider how much mortgage debt you have and your timeframe for paying it off. With marriage and a bigger family usually comes a bigger house that one spouse wouldn’t be able to afford on their own. And you want to avoid leaving your partner in a situation where he or she would need to deplete savings to pay off the house note or uproot your family to a more affordable living arrangement.

Make sure your policy is large enough to pay off the mortgage and that the term length (assuming you go with a term life insurance policy) keeps your family covered through the anticipated payoff date. For example, if you have 20 years left on your mortgage, make sure that the term length is at least 20 years to see your family through a mortgage-free life. The term length of a policy is the period of time that, while paying your premiums, your family would receive a life insurance death benefit. Typically, life insurance term lengths come in 10, 15, 20 and 30-year increments and should align with the timeframe of your financial responsibilities.

Same goes for any other substantial debts you might have (such as medical expenses, for example.) If there’s any chance that debt would be left to your partner, or any family member for that matter, make sure a life insurance policy, with a suitable term length, can cover it.

Cosigned Debts

Complementary to the point above, it’s important to consider any cosigned debts you may have. For example, many Americans are graduating with student loan debt that, if privately funded, was likely cosigned by a parent or other family member. Federally funded loans are typically forgiven in the event of death, but that’s not always the case with privately funded loans. Even if it’s $5,000, that could be a substantial amount of money for your cosigner to take on in the event of your death. And you’re probably already aware that higher education degrees can result in loans upward of $100,000.

Write down all the debts you have – mortgage, credit card, student loans, etc. – and put a name (or names) next to it for who might be left to pay it off. If you have any names next to the debt, figure that into your overall life insurance policy amount.

Life insurance isn’t one-size-fits-all. Click here to find out how much coverage you really need.

Child Care and Dependent Expenses

We love our children, but, boy, are they expensive. It’s estimated to cost around $233,610 to raise a child to 18 in a middle-income family. And that doesn’t include college expenses.

Having children is a common reason why people finally pull the trigger on buying a life insurance policy because many realize their partner wouldn’t be able to afford to raise children on their own. Or, maybe they could, but it would require a significant lifestyle adjustment, which would be very challenging during an already trying time.

Make sure your life insurance coverage can cover your children to at least the age of 18. Also consider if you’re planning to pay for their college tuition at a state or private university because that’ll change the scenario a bit, too.

Aside from just children, many people have plans or a current need to care for an elderly parent. Make sure their care is factored into your decision, as well.

Stay-at-Home Parents

The work stay-at-home parents do for a family is a full-time job and would be expensive — $113,586 a year to be exact — to replace. Many don’t think stay-at-home parents need life insurance coverage because they aren’t the primary breadwinners of the family. However, consider the added costs in household and child care expenses if a stay-at-home parent’s time would need to be picked up by a nanny or childcare service.

While it’s impossible to replace the love and day-to-day care of a stay-at-home parent, it is important to consider the financial impact they have in your household and to make sure they’re covered appropriately.

End-of-Life Expenses

Funeral expenses, much like all expenses due to inflation, continue to rise year over year. Currently, the average funeral costs $7,181.

While in the grand scheme of things, $7,000 might not seem like a ton of money, anything you can do to alleviate financial and emotional concerns (by the way, you should have a living will) is very impactful to grieving loved ones.

Outside of funeral costs, consider the potential need to cover unpaid medical bills or taxes if you’re not around.

Term life insurance can cost less than a few lattes. Get your free quote.

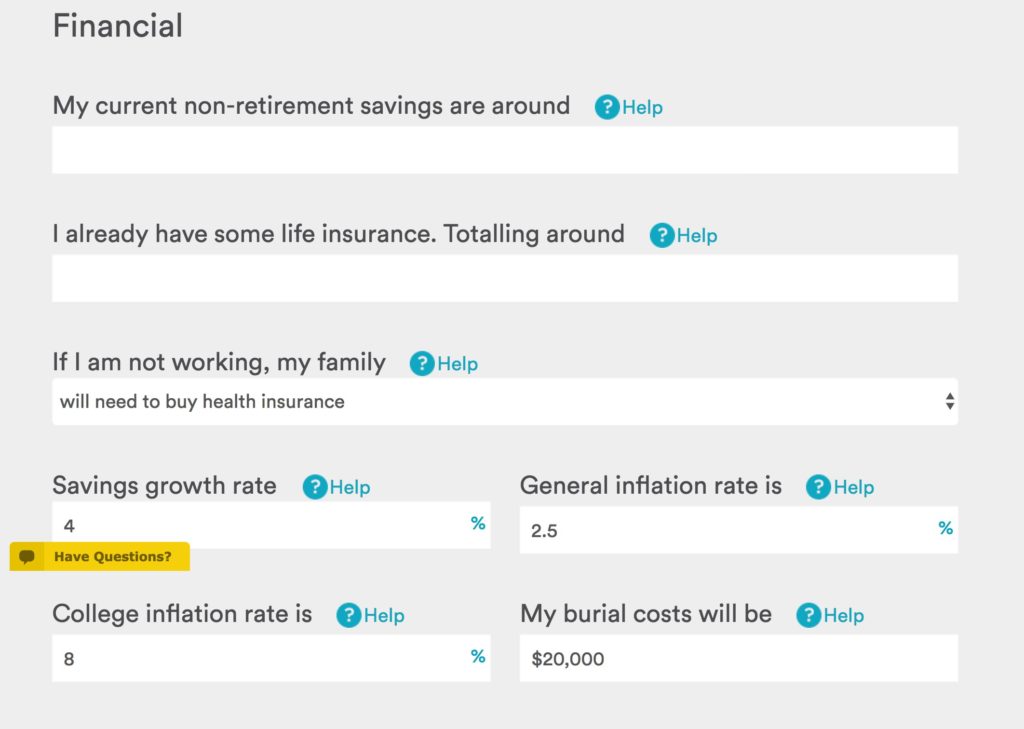

Current Savings

We’re not here to sell you too much life insurance. We want you to get just the right amount so that you know your family is financially cared for. And, we don’t want you to have too much coverage to where you’re spending money that could be better put into savings or used in investment accounts. That’s why it’s important to take into consideration liquid savings, investment accounts, retirement accounts and anything you have saved for your children’s education when determining your needs.

Unfortunately, many Americans couldn’t easily pull together even $400 from liquid savings. This scenario creates a significant financial need for life insurance, and we’d encourage you to err more on the side of caution and choose a higher tier of coverage. (Our coverage calculator gives you three recommended tiers of coverage – silver, gold or platinum.)

If you live a more frugal lifestyle and have a wealth of liquid assets, it may reduce your need for life insurance because you are, in a sense, self-insured. When you fall into this category, make sure you choose “advanced settings” on our online life insurance calculator and / or look for a way to include those assets into your coverage consideration. Advanced settings allow you to include important information about your assets that’ll keep you from being over insured.

A Legacy

Beyond simply covering daily living expenses and anticipated bills, many people who buy life insurance do so to leave behind a legacy. If they should happen to die early, these people want to do more than cover daily bills; they want to leave behind extra cash for their children and other family members to access as they age.

Picking the Right Amount of Life Insurance Coverage: It Doesn’t Need to Be Complicated

After scanning through all those expenses above, you probably think picking the right amount of coverage is going to take a good amount of number crunching and listing all your expenses in one spreadsheet.

It doesn’t need to be that complicated. Knowing what you do about your income and overall net worth, use an online life insurance calculator to easily help you pick the best coverage for your family. Our calculator even gives you three tiers of recommended coverage levels and provides a rationale for why it came to those options if you click “details.”

Choosing a Life Insurance Provider

Once you decide on the right amount of coverage, it’s time to figure out where you should buy life insurance.

When comparing providers consider the following:

- Term or permanent life insurance. There are two main types of life insurance: term and permanent. Term life insurance is one of the simplest and most affordable types of life insurance and is characterized by its set term lengths of coverage – 10, 15, 20 or 30 years. It’s the only type of insurance we offer at Haven Life because of its affordability, simplicity to manage and ample coverage. In contrast, permanent life insurance coverage lasts a lifetime and accrues cash value that can be borrowed from over time. As it tends to be more complex than term insurance, it often requires the assistance of a financial professional or agent. The premiums on a permanent policy are usually upwards of 15 times the monthly amount of a term policy. Further, loans from the policy reduce the cash value and death benefit.

- Check the rating of the provider. A company such as A.M. Best does the homework on an insurer’s claims-paying ability and track record, to help determine whether the provider is considered reliable and in good financial standing. The higher the rating, the more favorable the company’s standing. We’d recommend providers rated A+ or better. MassMutual, which issues our Haven Term policy, is rated A++ by A.M. Best.**

- Choose a policy with level premiums and a sufficient duration. When it comes to term life insurance, level premiums mean that your monthly costs will not go up over the length of the term. And your term duration should be long enough to get you past any major expenses, such as a mortgage or when the kids are finished with college.

- Pick a process. There are two main ways to buy a policy: through an agent or buying life insurance online. At Haven Life, we’re partial to online because that’s what we offer, and it allows you to get covered immediately and on your own time. But, some people prefer the help of an agent through the entire process, if that’s the case, the traditional method might be a better option for you.

Purchasing life insurance can be daunting because of all the factors you must seemingly consider. Fortunately, efforts have been made by us and the rest of the industry, to make picking the best policy as simple and affordable as possible.

What matters most is that you don’t put off buying a policy when you know your family needs the protection. If you have loved ones who rely on your earnings, life insurance is a responsible way to help ensure they are financially cared for after you’re gone. Planning for this sooner, rather than later, provides your family with necessary financial security and gives you some much-needed peace of mind.

Protect the ones you love most. Start by getting a free quote.

**MassMutual and its subsidiaries C.M. Life Insurance Company and MML Bay State Life Insurance Company are rated by A.M. Best Company as A++ (Superior; Top category of 15). The rating is as of December 15, 2016 and is subject to change. MassMutual has received other ratings from different rating agencies.