On March 29, 2017, senior Democrats introduced comprehensive legislation (titled the Improving Access to Affordable Prescription Drugs Act) in the House and Senate aimed at lowering prescription drug costs and improving transparency.

The 129-page bill contains several popular provisions that could help drive its passage or could reappear in a future bipartisan attempt to repair or replace the Affordable Care Act.

One such provision is section 202, which establishes an excise tax on drugs with price increases exceeding the inflation rate. The amount of the tax penalty would depend on the size of the price increase. It is modeled on similar rebates already in place for Medicaid, the Department of Veterans Affairs (VA), and the Department of Defense.

We estimate that the proposal could generate several billion dollars annually just from sales through the Medicare Part D program. In this post, we examine how this proposal is structured and evaluate the implications of the proposal for patients, public insurance programs, and innovation.

Proposed Tax On Drug Price Spikes

The bill defines a “price spike” as an increase in the average manufacturer price—on a calendar year-over-year basis—exceeding inflation (the medical care component of the Consumer Price Index for All Urban Consumers [CPI-U]). Section 202 would tax US revenues earned by manufacturers from a price spike for any prescription drug covered by a federal health care program. Revenues arising from an annual price increase above inflation but below 15 percent would be taxed at 50 percent; the tax rate is 75 percent of revenues for a price increase between 15 percent and 20 percent and 100 percent for a price increase above 20 percent.

Section 202 would also tax cumulative price increases over a period that is the least of:

- the five most recently completed calendar years,

- all years that the drug was sold in commerce, and

- any calendar years after March 29, 2017. Revenues from cumulative price increases exceeding inflation during this applicable period would be taxed according to the following schedule (see Table 1):

Table 1: Schedule Of Compounded Percentages For Proposed Cumulative Price Spike Tax Calculation

| Number of years in applicable period | First compounded percentage | Second compounded percentage |

|---|---|---|

| 2 | 32.35% | 44.00% |

| 3 | 52.09% | 72.80% |

| 4 | 74.90% | 107.36% |

| 5 | 101.14% | 148.83% |

Similar to the annual price spike tax, revenues arising from a cumulative price increase above inflation but below the first compounded percentage (shown in the table above) are taxed at 50 percent; 75 percent for a price increase between the first and second compounded percentage; and 100 percent for a price increase above the second compounded percentage.

Prior to enforcement of the tax, manufacturers would be allowed to deduct the amount of the taxable price spike revenue, as determined by the Department of Health and Human Services’ Inspector General, that is due solely to an increase in the cost of goods necessary for the drug’s manufacture. Failure to submit the necessary information on prices and revenues would result in a civil penalty equal to between 0.5 percent and 1.0 percent of gross revenues per day of delay.

The bill would authorize Congress to appropriate tax revenues that are collected to increase funding for the National Institutes of Health and to fund research on the economic and policy implications of prescription drug price patterns.

Impact On Medicare Part D

To estimate the potential impact of the proposed tax for Medicare Part D prescription drug spending, we used Part D prescription drug event (PDE) summary drug-level data for calendar years 2011 through 2015. These data include all Part D plan types and cover roughly 70 percent of Part D beneficiaries. We obtained average annual inflation rates (the medical care component of the CPI-U) from the Bureau of Labor Statistics.

We focused on changes in the wholesale acquisition cost, as average manufacturer prices are considered confidential. However, by rule, the average manufacturer price must exclude rebates or discounts provided to federal purchasers as well as pharmacy benefit managers, managed care organizations, health maintenance organizations, and insurers. Thus, changes in average manufacturer prices are more likely to mirror changes in list prices, such as wholesale acquisition cost, than net prices that account for rebates.

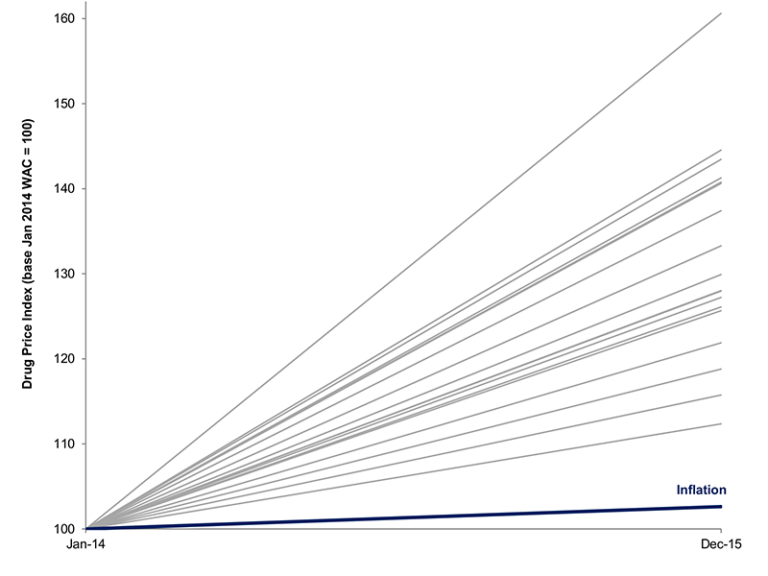

The wholesale acquisition cost of drugs commonly used by Medicare Part D beneficiaries has risen substantially on both year-over-year and cumulative bases (see Figure 1). In 2015, 1,805 drugs, representing 68 percent or $92.8 billion of gross Part D spending, had annual price increases exceeding inflation, of which 638 had price increases above 20 percent. And between 2011 and 2015, 1,088 drugs had cumulative price increases above 50 percent and 481 drugs had cumulative price increases above 100 percent.

Figure 1: Linearized Annual Change In Wholesale Acquisition Costs For Top 20 Drugs By Medicare Part D Spending, 2014–15

Source: Authors’ calculations. Note: WAC stands for wholesale acquisition cost.

Overall, the implied tax liability from Medicare Part D sales in 2015 from the proposed annual price spike and cumulative price spike taxes is estimated to be approximately $9 billion and $26 billion, respectively. Figure 2 shows the tax bills that would have been accounted for by Part D sales for drugs that had both annual and cumulative price spikes in 2015.

For example, the wholesale acquisition cost of pregabalin (Lyrica), which is indicated to treat neuropathic pain, postherpetic neuralgia, and (as an adjunctive therapy) partial onset seizures, increased by 19 percent between 2014 and 2015 and by 86 percent between 2011 and 2015. The implied annual and cumulative price spike taxes from Medicare Part D sales alone are roughly $200 million and $600 million, respectively.

Similarly, the wholesale acquisition cost of ezetimibe (Zetia), a lipid-lowering agent, rose by 16 percent between 2015 and 2014 and by 88 percent between 2011 and 2015. For Part D, the implied annual and cumulative price spike taxes are roughly $200 million and $400 million, respectively, for this drug.

Figure 2: Implied Annual And Cumulative Price Spike Taxes For Part D Drugs, 2015

Source: Authors’ calculations.

Policy Implications

If enacted, the proposed tax could fundamentally alter the dynamics of pharmaceutical pricing in the United States and result in initial tax receipts of up to tens of billions of dollars annually. Policy makers should carefully consider the implications of this tax for patients, public insurance programs, and biomedical innovation.

Allowing Patients To Share In Savings From Drug Rebates

Due to rebates and other discounts, the actual price paid by insurers for a drug (that is, the net price) is nearly always lower than the drug’s sticker price. Over time, the gap (or spread) between the list and net prices can grow rapidly. However, the approximately 28 million people who are uninsured may have to pay the list price, and under the current system increases in list prices also impact the insured: Since applicable coinsurance and deductibles are based on the list price of drugs, an increase in the list price could increase patients’ out-of-pocket costs even if the net price has not changed.

As currently drafted, the proposed tax aims to discourage rapid increases in drug prices, which in turn could slow rising out-of-pocket prescription drug costs in the future. However, there are more direct ways that consumers should benefit. For example, insurers must provide rebates to their customers if they spend less than a certain amount of premium dollars on medical care (known as the medical loss ratio). Similarly, the legislative proposal could be revised so that for prescription drugs with list prices that rise faster than their net prices, consumers could share in the rebates and reduce their out-of-pocket costs from funds that currently flow to pharmacy benefit managers and insurers.

Interaction With Medicaid And Other Rebates

The proposed tax differs in certain respects from model rebate arrangements in Medicaid, the VA, the DOD, and others. On the one hand, the tax is less restrictive than the Medicaid rebate, which requires 100 percent of revenues from price increases exceeding inflation to be returned and defines the applicable period according to the first year the drug is sold. On the other hand, the tax applies to all drug sales in the United States. Since it is assessed based on changes in the average manufacturer price, which excludes rebates, manufacturers may have to pay price spike taxes in addition to statutorily defined rebates to Medicaid and others. This could further speed changes in pricing strategies, such as slowing list price increases and compressing gross-to-net spreads, for the benefit of patients.

Providing Tax Relief When Price Increases Stem From Legitimate Reasons

As currently drafted, manufacturers can reduce their tax liability by deducting the part of a price spike due to changes in the cost of goods needed to produce a drug. Although in many cases drug price increases do not occur for this reason or for any apparent changes in the value provided to patients, in certain situations, there may be justifiable reasons for a price increase. For example, post-approval clinical studies may provide strong new evidence that a drug is more effective, or safer, than originally believed; alternately, a drug may receive approval for a new or expanded indication.

As we continue to shift our health care system to one that better prioritizes value for populations as well as individual patients, manufacturers should be able to petition to have such factors considered in the context of price increases, with opportunity for public input and formal empirical scrutiny.

Effects On Innovation

The question of the proposed tax impact on innovation will invariably be raised. The authors of one Health Affairs Blog post argue that the higher prices paid by US patients and taxpayers do not appear necessary to fund research and development.

Analysts at Goldman Sachs estimate that the percentage of revenues in the past five years due to price growth above inflation ranged from less than 5 percent (Bristol-Myers Squibb, Merck, Regeneron Pharmaceuticals) to 15–20 percent (Pfizer) to above 50 percent (Horizon Pharma). As the CEO of Regeneron noted at the Forbes Healthcare Summit last year, “We, as an industry, have used price hikes to cover up the gaps in innovation.” The burden of a price spike tax would be borne by those companies that rely disproportionately on price increases, rather than innovation, to drive returns.

Note: For the relevant section, please see 11:45–12:55.

A Potential Push Toward A Broader Solution To Drug Price Increases

Finally, some companies have already announced pricing policies consistent with the proposed tax. For example, AbbVie and Novo Nordisk pledged recently to limit branded drug price hikes to single digits annually; the CEO of Allergan called for a “social contract,” with a goal of reducing price increases to the rate of inflation—just like the proposed tax.

The threat of a far-reaching tax could provide further impetus for a negotiated agreement, potentially brokered by Congress and the Trump administration, on limits to drug price increases. One model is the Pharmaceutical Price Regulation Scheme in the United Kingdom, which is a voluntary arrangement between the UK Department of Health and the Association of the British Pharmaceutical Industry. Under this agreement, which was first introduced in 1957 and is periodically renegotiated, participating companies agree to cap price growth for brand-name drugs for the following five years.

To date, reform of pharmaceutical prices—balancing the value provided by new medicines with the burden of escalating costs on patients and payers—has been stymied by resistance from parties benefiting from the complex status quo. The tax proposal, among other provisions in the Improving Access to Affordable Prescription Drugs Act, could help move real change forward.

Authors’ Note

Dr. Kesselheim is supported by the Harvard Program in Therapeutic Science and the Laura and John Arnold Foundation, and has received unrelated research support from the Food and Drug Administration’s Office of Generic Drugs and Division of Health Communication. Mr. Hwang reports prior employment by Blackstone and Bain Capital, which have invested in health care companies. The authors’ funders and employers had no role in the preparation, review, or approval of this work and the decision to submit this work for publication.