Millennials are – or are about to become – parents.

Actually, 9,000 per day if you’re keeping score at home.

So, how are we doing so far?

Good question.

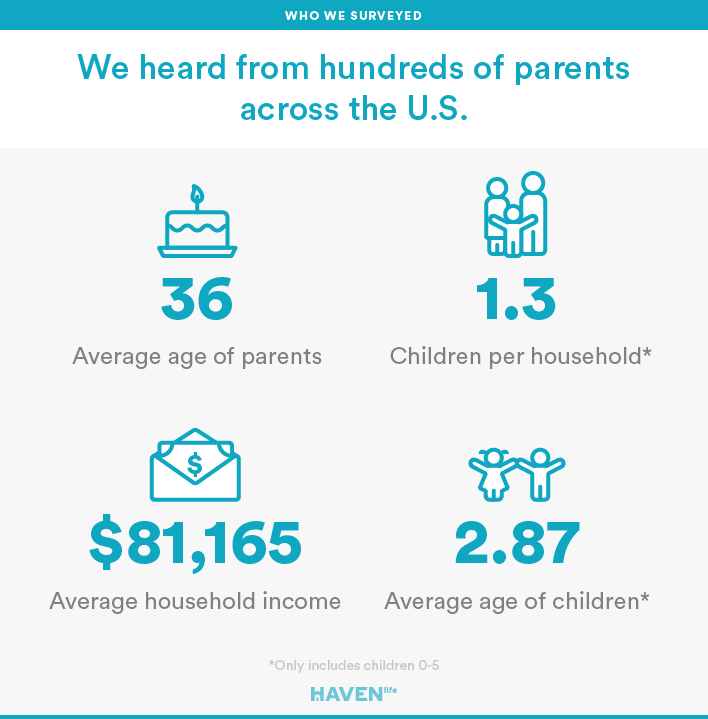

Haven Life surveyed parents (with children ages 0-5) to find out what they are prioritizing when raising Generation Alpha.

“How the Next Generation of Parents Are Dealing with Parenthood” paints an interesting picture. One of moms and dads who are highly invested in their kids’ lives and well-being, yet ill-prepared to deal with the financial realities of their future.

How the Next Generation of Parents Are Dealing with Parenthood

The Price of Parenting

Kids cost a lot (you don’t say…).

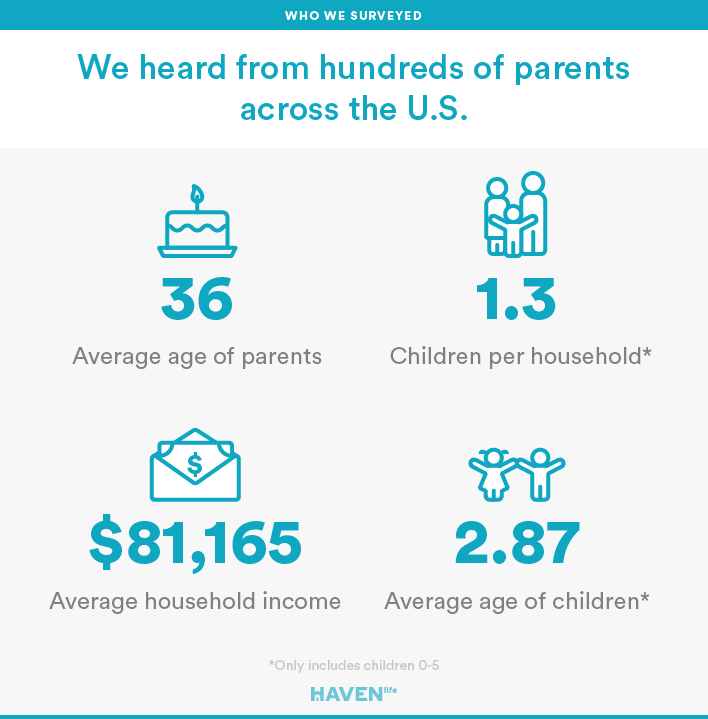

Next generation parents with children between the ages of 0-5 are spending about $10,000 a year (or 12% of their average household income) on regular child care alone. Combined with the fact that many Americans are devoting 30% of their income to keeping a roof over their heads, and that’s 42% of all money earned gone.

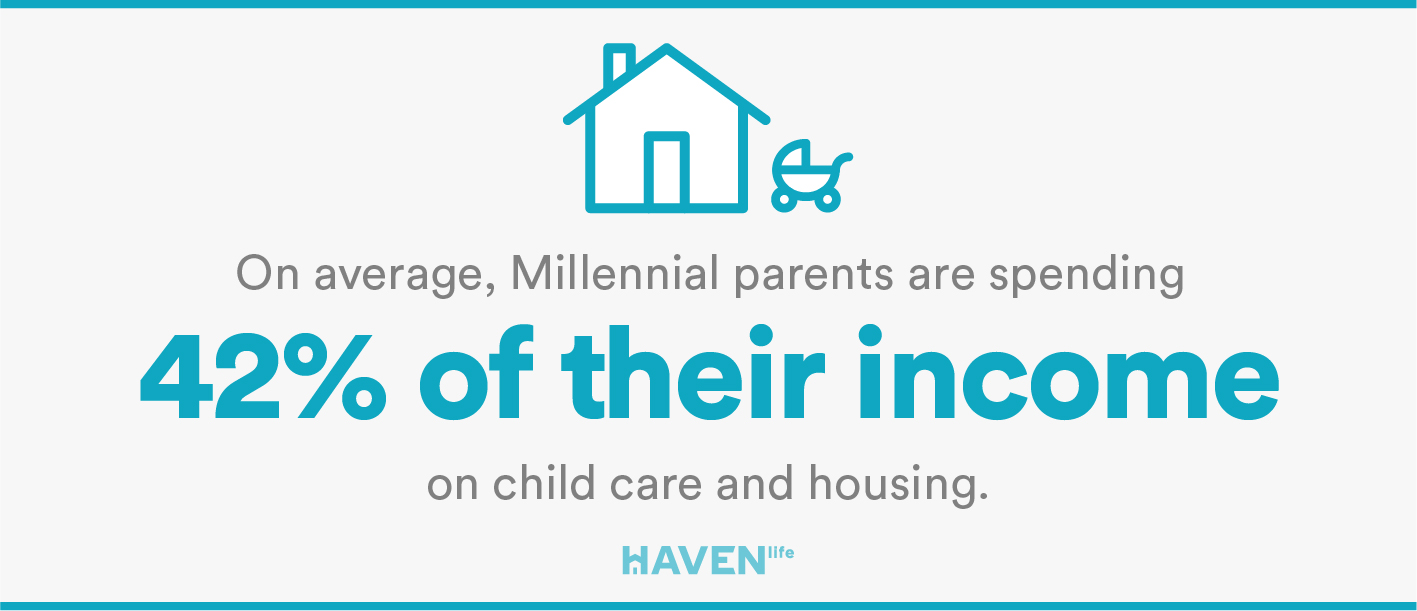

Today, maybe more so than ever, parents are being forced to rely on mindful budgeting when it comes to child-related expenses. “Healthcare” and “costs associated with maintaining a healthy diet” are where new parents are predominantly dedicating their dollars.

College savings, on the other hand, are a priority for just 13% of this group despite the fact that the average total cost of a four-year degree from a public school is anticipated to be more than $205,000 by 2030.

“By making college savings such a low priority, parents are missing out on the benefits of compounding investment returns from tax-advantaged programs like 529 Plans or even minimally aggressive investment accounts. That is more money potentially left on the table that isn’t being tapped.” – Bobbi Rebell, Personal Finance Expert and author of How to be a Financial Grownup.

Of course, the cost of parenting extends beyond just dollars. Moms and dads are sacrificing a tremendous amount of their time, too. In fact, today’s parents are getting less than an hour (55 minutes to be exact) to themselves per day.

This is not meant as an indictment. Rather, it’s an indication of how invested these parents are in making a positive and present impact in their children’s lives.

What Keeps Millennial Parents Up At Night

Sure, feedings and changing and repeated requests for just “one more book” (or perhaps “one more video”) all play a factor in the 6.5 hours of sleep that Millennial parents are getting per night. But there are other unique stresses of raising young children in 2017 that weigh heavily on the minds of these moms and dads.

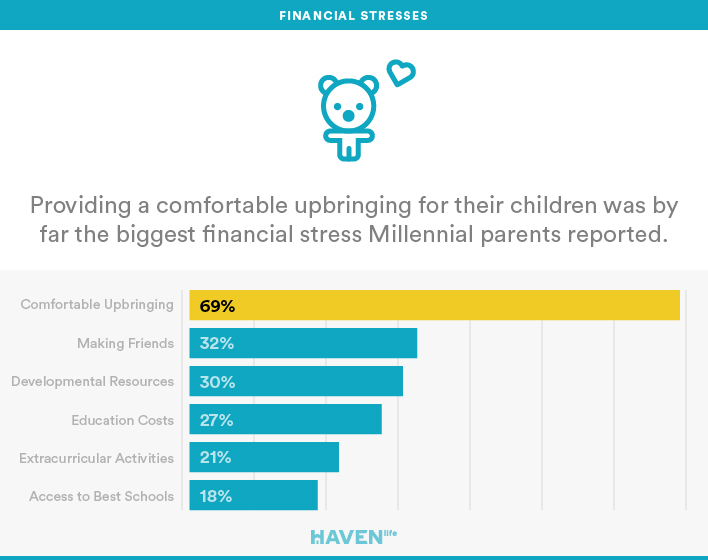

Over a third of parents surveyed said that “hoping their kids could make friends / be social” was a cause for considerable concern. Meanwhile, another 27% cited “the cost of education/childcare” as a primary anxiety. Still, as significant as those figures are, both pale in comparison to the pressure of being able to provide for their families financially.

It’s also revealing that almost 10% of parents are already emphasizing for their children the value of “earning a substantial income.” Remember, these are parents of kids ages 0-5.

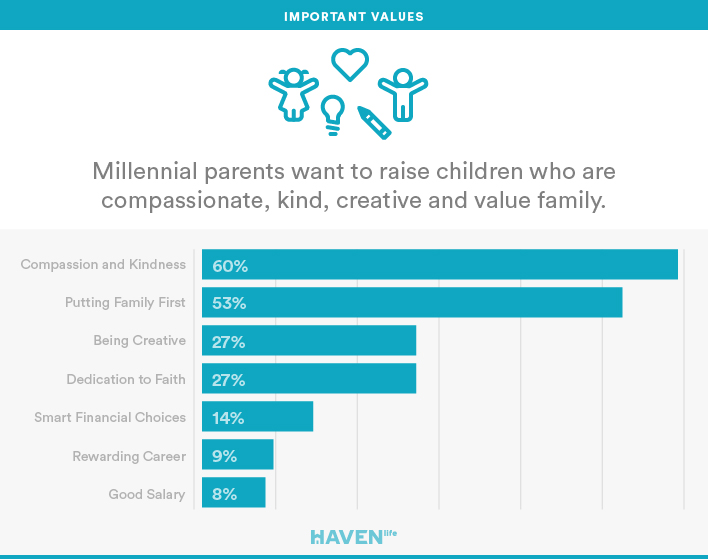

Still, this generation of parents (just like the generation before them and the generation before that) are trying to raise compassionate, kind and creative little ones who have a dedication to faith and put family first.

The Protection (Or Lack Thereof) These Parents Are Providing

We didn’t need to survey parents to know that they all want to protect their children.

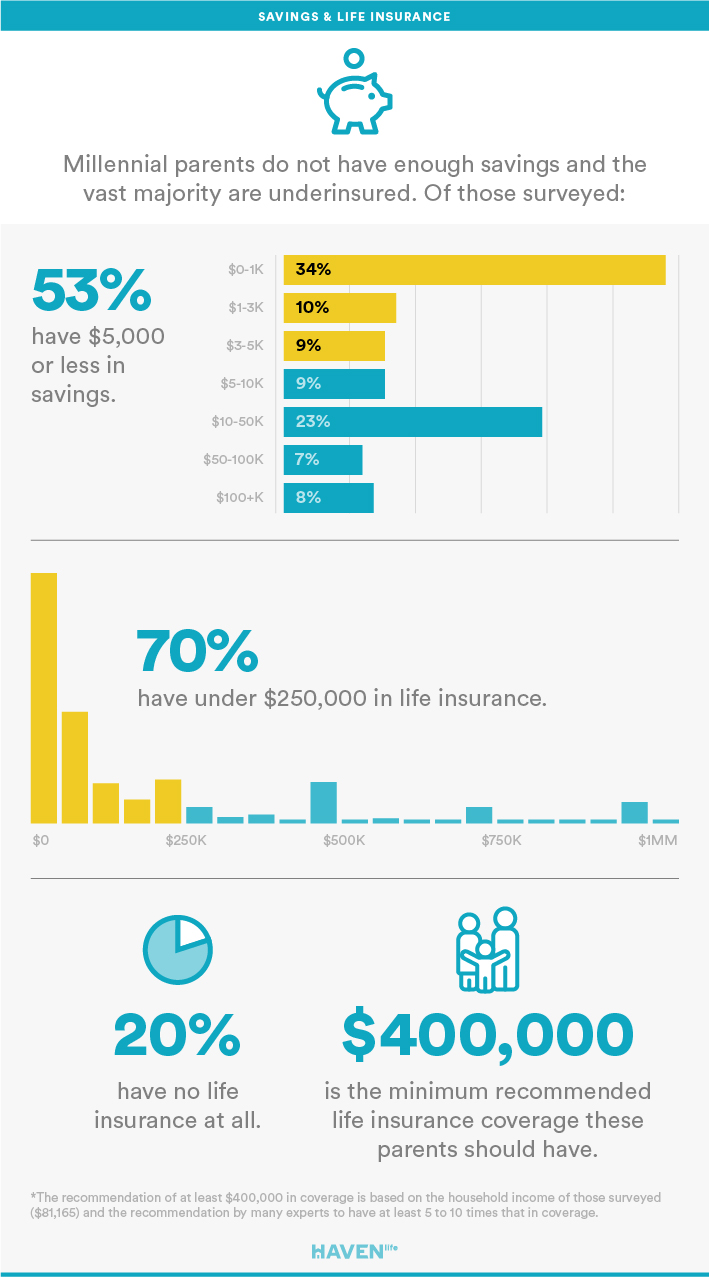

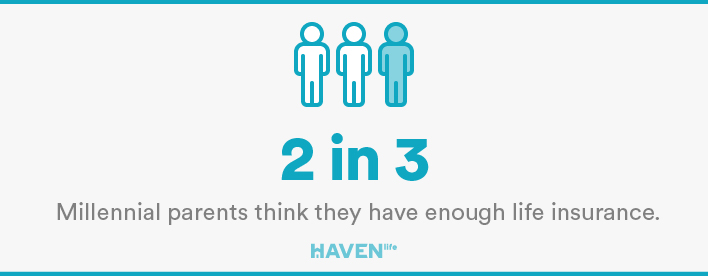

While they are focusing on everything from instilling proper values to providing a healthy diet, there’s one critical area where much of this generation is dropping the ball: financial security. Of the parents we heard from, 53% have $5,000 or less in savings and 1 in 5 have no life insurance at all. Of those who do have life insurance, 70% have under $250,000 in coverage. They’re underinsured.

“Many parents are not aware of the risks they are taking with their children’s future. They need to think about their financial priorities and take action on not only boosting their savings but also making sure they have the right life insurance coverage in place.” – Bobbi Rebell

This misconception likely comes from either not knowing the recommended amount of coverage that is needed to protect their families financially or by assuming their employer-provided coverage is enough. Experts recommend coverage that’s equal to five to ten times your annual salary. Employer-provided life insurance typically only amounts to one or two.

Life insurance helps your family remain financially stable if you’re no longer around. And if you have a spouse and children who depend on you, it’s virtually a necessity. Plain and simple.

The Reality Of The Situation

Millennial parents have the best of intentions when it comes to raising kind, smart, well-rounded children. They are sacrificing personal time and dedicating financial resources to give their kids the best childcare, diet, educational support and enrichment activities that their budgets (and beyond) can provide.

Yet, they are leaving a gaping hole in their family’s financial safety net. Between a lack of savings and an apathy toward life insurance, these families will find it very difficult to maintain their current lifestyle. Especially if something unexpected were to happen to a parent.

Fortunately, the solution to start solving this growing problem is an easy one. And for Millennials, probably a very familiar one too. It involves their smartphone, tablet, and laptop.

Technological advancements in the financial space have made it easier than ever to manage your money and proactively protect loved ones. There are budgeting and autosave apps, Robo Advisers for investment accounts, and streamlined and digital platforms for insurance products. They all cater to a need for a simple, structured plan for their financial future that busy parents can accomplish with both confidence and speed.

Which, seems pretty important considering they only have 55 free minutes a day.

Protecting your family with life insurance is more affordable than you think. Get your free quote

Haven Life Insurance Agency, LLC conducted the Next Generation of Parents study during March 2017. It involved a 29-question, online survey administered to a sample size of N=500 adults ages 18-59 with children ages 0–5 years old.