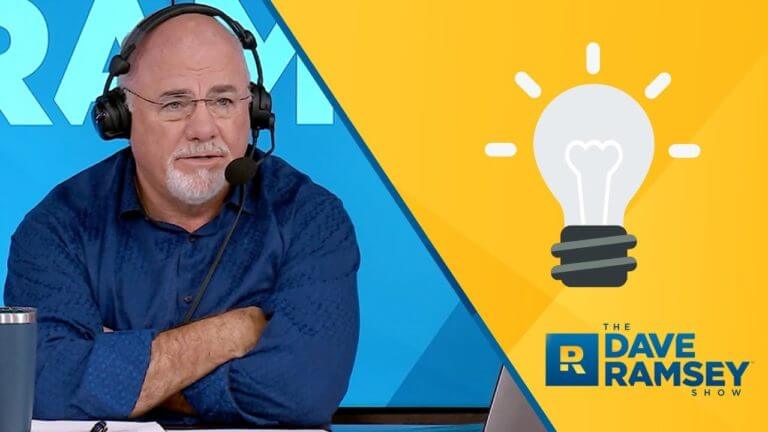

Did you miss the latest Ramsey Show episode? Don’t worry—we’ve got you covered! Get all the highlights you missed plus some of the best moments from the …

Did you miss the latest Ramsey Show episode? Don’t worry—we’ve got you covered! Get all the highlights you missed plus some of the best moments from the …

Hi Dave, how come the IRS limits how much money you can put into a life insurance contract? ?

I wonder what Dave's opinion is on Final Expense Burial Policy's . For people on fixed incomes such as social security or disability where they don't have the funds to take care of it themselves therefore the bill gets passed on to their loved ones to pay .

Dave Ramsey doesn't know what he is talking about when it comes to life insurance. Term insurance was never meant to be kept for decades. As you get into your 50s term becomes very expensive.people drop term policies right when they need it. Crazy. Whole life does what it is supposed to do, provide a tax free death benefit.This is why wealthy families use WL insurance to pass on n estate.

And all this time I thought Warren Buffett and Charlie Munger knew what they were doing.

Continued compound interest… sounds good. Able to take money out reinvest and the money still grows like you never took it out. Show me the math!

He says “he’s here for his listeners, the consumers” yet talking like he knows how every policy works LOL I agree it should not be used as investment, but just like anything there are pros and cons. This guy is a stubborn barking dog, period.

So I need help understanding something. I’m 30 years old, I am in the process of obtaining a 30 year term policy, only issue is that the as I get older the annual premium significantly increases. But with the whole life policy the annual premium is guaranteed for life. What move would you guys make??

This is the one thing he’s wrong about. If you buy from a mutual company with a long history of dividends it’s better than term

What about if I don't qualify for term?

Okay, but if you get term, and u don’t die in that term, that money is pocketed, right?

I have some term life insurance in case something really bad happens, but every month I put a little bit of money into the S&P month after month no matter what. I think thats the simplest path.

You made this crystal clear! Thank you for leading us into the light instead of to the slaughter like the rest of these whole life selling you tubers.

Well I just thought of one case where this analysis does not hold up and that is the case where you are using the dividends to buy more insurance. In that case the return would be in the form of a higher payout. The return on investment is still probably low though and equivalent to cash.

It's worth noting that one of Dave Ramsey's sponsors is Zander insurance, which is a term only company

The demographic that buys Whole Life doesn't know about investing…they are procrastinators and have bad spending habits and no retirement planning. They just want a band aid if something happens to avoid a car wash or Go Fund Me.

I'm one of the slime balls that has delivered checks to help a family in need when something unexpected has happend.

What an incredibly simplistic view

Yes, whole life is a great product, I dont sell it, I understand it and can explain the math.

Where do banks put a lot of their cash reserves?

Thank you for sharing this Dave. I was recruited by Max Life Agency under PHP (Valuetainment). I like the content Pat posts online, it’s good, but I trust Dave. Selling Whole Life Life Insurance is sending the financial wolf to the ignorant sheep.

People get rich from it at the cost of their conscience.

Also, how do you hedge against long-term care needs in late retirement without whole life and your term ins expired?