Other parts of this series:

Digital aggregators – friend or foe? This question is vexing many big insurers around the world.

In some countries, particularly the UK, carriers view aggregators as essential components of their distribution network that generate valuable sales. Others perceive them as rivals that are eroding their business, commoditizing their industry and jeopardizing the interests of customers.

The question is important. As insurers transform their distribution networks to take advantage of the huge potential of digital technology they’ll have to think about how to position towards aggregator platforms. How they tackle this challenge will have a big impact on the performance of these new digital distribution channels. Furthermore, aggregators are already taking big revenues away from insurers in some markets. Carriers need to consider their options and develop effective strategies.

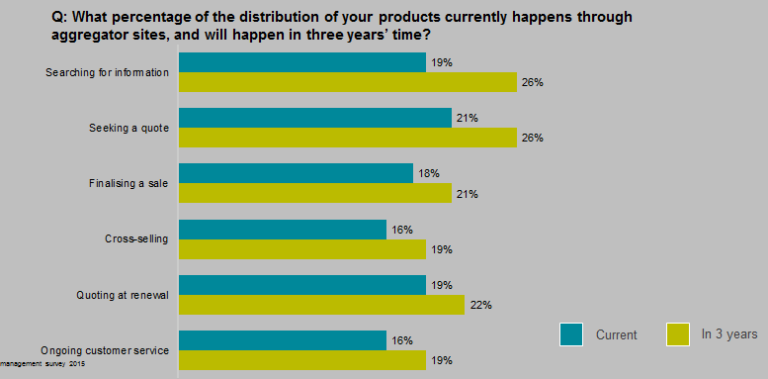

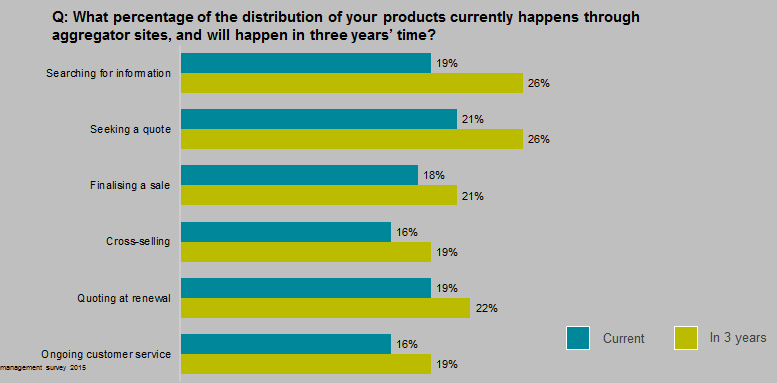

Our 2015 Distribution & Agency Management Survey shows that most insurance executives expect aggregators to have a bigger influence in the distribution of their products over the next three years. Consumers will increasingly turn to them to find information, obtain quotes and finalize sales.

What’s not clear is how this is going to affect specific products and markets. In the UK, for example, aggregators have transformed the automotive insurance industry and are highly influential. They’ve gained footholds in many other countries and market sectors. But their profile differs considerably depending on many factors: strength of insurance brands, presence of lower costs producers like P&C mutual, regulatory barriers….

What is certain is that most insurers are responding in some way to the presence of aggregators. They’re adopting strategies that will either capitalize on, or counter, the growing success of these platforms. Fifty-one percent of executives we surveyed around the world are considering defining a low-cost product set specifically for aggregators. A slightly larger proportion expect to use aggregators under sub-brands, rather than their main brand, during the next three years. The extent of this approach is similar across all the main insurance lines. However, it’s more prominent in North America (55 percent) than in Europe (45 percent).

Regional differences come to the fore when we look at how many insurers are planning to set up their own aggregator sites; an interesting emerging strategic option. Fifty-seven percent of respondents say they’re considering this move. However, 83 percent of insurers in the UK are looking to operate their own aggregator services compared with 58 percent in the US and 54 percent across Europe.

In the face of the rising presence of aggregators, carriers throughout the world are confronted with a variety of options. There’s no text-book answer.

Where possible, cautious engagement with aggregators may be the shrewdest approach. This allows insurers to better understand the effect of aggregator platforms on their business without making themselves too vulnerable to potential competition.

Next week in the final blog of this series, I will look at what digital transformers are doing differently to benefit from digital transformation.

For more information about Accenture’s 2015 Distribution and Agency Management Survey follow this link: www.accenture.com/InsuranceDistributionSurvey