Other parts of this series:

The digital transformation of the insurance industry is dramatically recasting the role of its sales agents.

Many of the tasks agents have traditionally performed are being transformed by the development of digital sales channels. And the trend is accelerating.

However, this doesn’t mean that sales agents will become obsolete. Far from it. Innovative insurers are adopting omni-channel distribution strategies in which agents perform roles that complement an array of digital channels. This mixed approach seeks to maximize the value of human qualities such as empathy, trust and a holistic understanding of customer needs and concerns.

Our research shows that lots of carriers are already looking to redeploy their sales agents. As many as 63 percent of the insurance executives we recently canvassed say they’re giving high priority to refocusing agents on activities that can add the greatest value. The extent of the trend varies across different countries. But almost all insurers are going to have to grapple with this issue.

Carriers are relooking at the role of their agents because of a major shift in customer expectations. They’re increasingly demanding personalized services that are available to them at any time and at any place. And one of the best ways to meet these demands is to digitize all or part of the sales process. As a result of this and other factors, there are going to be fewer agents selling insurance. This is already happening in the property and casualty business and is starting in life insurance.

So where are they going be to be deployed? Providing customers with advice and insight, cross-selling wide ranges of products, and building deeper relationships with customers.

All of these are high-value activities. Most will be linked closely with automated digital solutions and provide the human touch these services lack. The shift in the role of sales agents will have two big consequences for insurers.

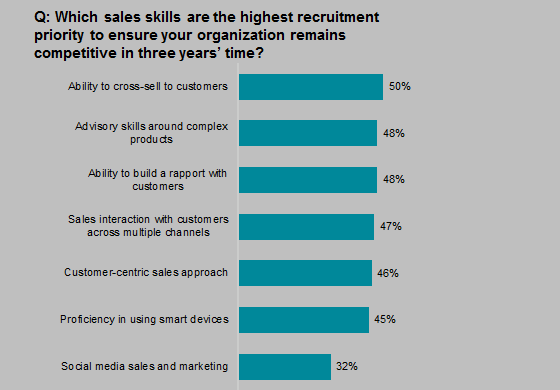

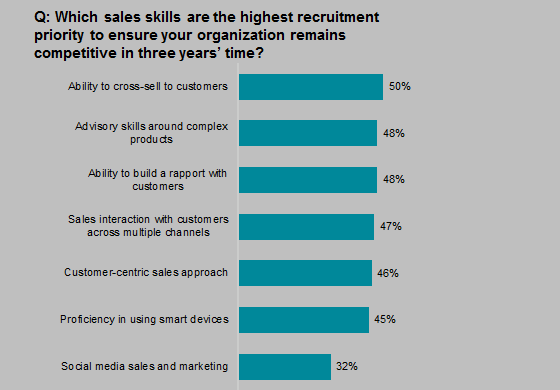

Firstly, they’ll need to change the skills of the agents they employ. This will require additional training and skills development as well as changes in recruitment objectives. Half the insurers in our survey said they need to recruit more agents with the ability to cross-sell. Demand for these skills was slightly higher in Europe than elsewhere in the world.

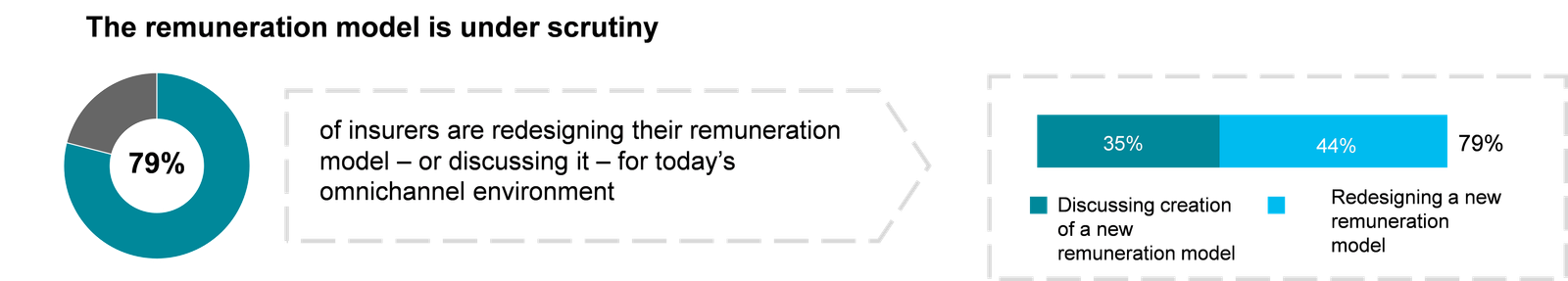

Secondly, insurers are defining new forms of incentives and remuneration. Traditional methods are not going to work. Indeed, close to 80 percent of the executives we surveyed have begun reviewing their remuneration models.

Sales agents will continue to play a valuable role in the insurance industry. But like the rest of the industry they’re going to be severely disrupted by far-reaching digital transformation. Insurers need a clear strategy that integrates agents within an increasingly digital and multichannel distribution framework where they will play a key role in deepening client relationships, providing critical advice, cross-selling and up-selling.

In my next blog I’ll look at how insurers are responding to challenges posed by the rise of digital aggregators.

For more information about Accenture’s 2015 Distribution and Agency Management Survey follow this link: www.accenture.com/InsuranceDistributionSurvey