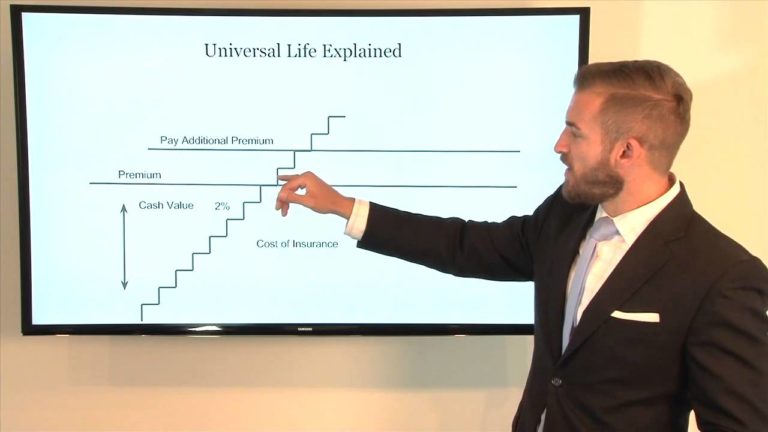

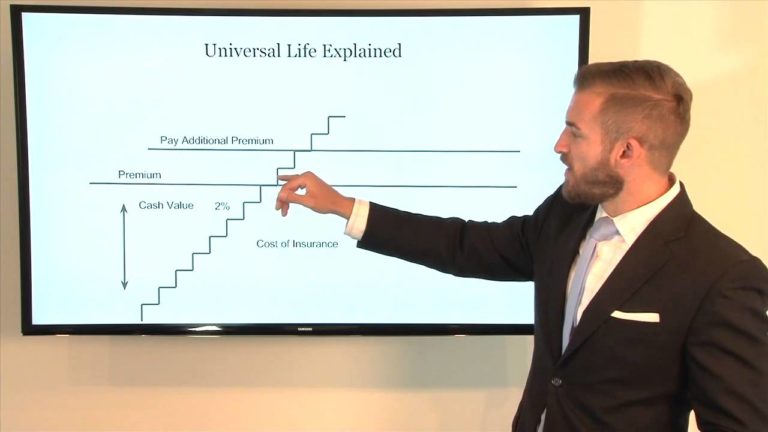

Learn how to describe universal life to your client so that they understand how the policy works! Effective and simplistic. After you watch this video, do not forget …

Learn how to describe universal life to your client so that they understand how the policy works! Effective and simplistic. After you watch this video, do not forget …

Excellent video!?

skip the intro at 4:41?

your videos are superb, congrats and thanks.?

Great video I'm wondering if you will you have any videos about whole life insurance and skills to help show people the need for life insurance other than the ones you already have?

At the beginning when someone has young kids, house/mortgage, consumer debt, and not much in savings towards retirement, that is when they should have a Term Policy. We can match their term policy to match the time they need it for. At the end of the policy the house will be paid off, no consumer debt, kids will be grown and out of the house, and they will have enough saved to live on and pay for a funeral if needed down the road. They are at that point, self insured.?

Dividends are a refund of premium. That means the companies overcharged the client and are just giving them some of their money back without interest, so the clients are losing money, because they could have used that money to invest and gain money all year in the market!Whole Life, Universal life, variable life..etc..are only great for the insurance agents paycheck, not for the client.?

For one Buy Term and Invest the difference is the way to go! The company I am with does Term life until age 95, giving them plenty of years to get our help with saving their money in the market. If they are older we put it into something safer, so they will never loose their principal investment. Putting savings and life insurance together never are a good idea. 2% rate of return mentioned on here is just keeping up with inflation so your customers are not growing there money. It is sad that the cost of insurance goes up, and then you guys take from their savings account. It is an absolute rip off.?

Wonderful explanation!?

you mAke no sense why should I have life protection forever, you never explain how for the first five years I have no money in my savings or after so many years my cash value decreases because of high insurance costs?

hi, i have a universal life insurance (face value of $250,000) i opened when i was single at 23yrs old (2004). Now (11yrs later), i have a family with kids. I was wondering if I should keep my UL insurance because an agent came to me and suggesting to close it and open a Term Insurance instead. She keep saying term is cheaper and that I should invest the difference. I'm not too sure what to do at this point. Thanks.?

thanks so much, this really clarifies the mystery.?

Is there a video on selling life insurance or a business topics that you are looking for? Let us know! We are here to help!?