The age of traditional business partnerships is long past. Today, strategic partnerships offer life insurers the ability to expand their businesses into new ecosystems. Whether investing in insurtechs or collaborating with partners in complementary industries, life insurers can build partnerships based not only on strategy, product and services but also on the merging of technology and the sharing of platforms.

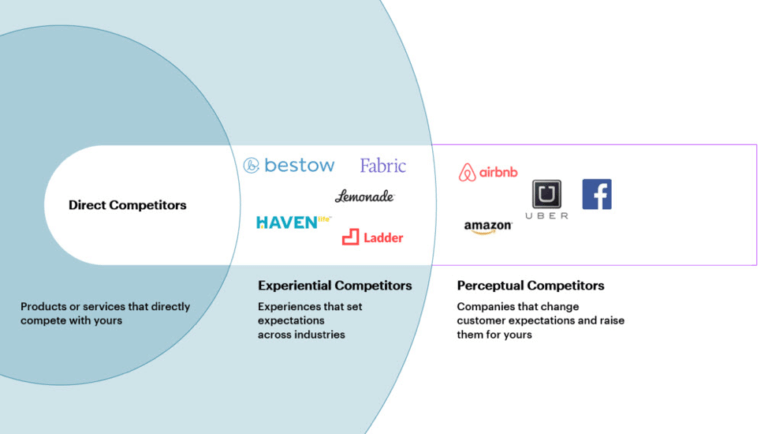

But the digital change that makes these new partnerships possible is also changing how customers look at all kinds of business. In a sense, everything now competes with everything else, as customer expectations for life insurance are set by digital leaders from other industries.

In response, many insurers are building more partnerships than ever before. Accenture’s Technology Vision for Insurance 2018 reveals that 38 percent of insurers work with double or more the number of partners they did two years ago.

For instance, the Chinese insurer Ping An has radically transformed itself through partnerships in recent years. Once a relatively straightforward P&C insurer, Ping An today offers a healthcare platform to its customers through the power of partnerships. Services include life insurance, health check-ups, and dental care.

But as these partnerships grow in number and complexity, they run into limits. The key problem: legacy tech systems weren’t built to support tech-based partnerships. These systems were built in silos, intended to operate within one business, with the assumption that change would be slow and steady. They simply can’t keep pace with the rapidly growing and shifting partnership landscape of the digital age.

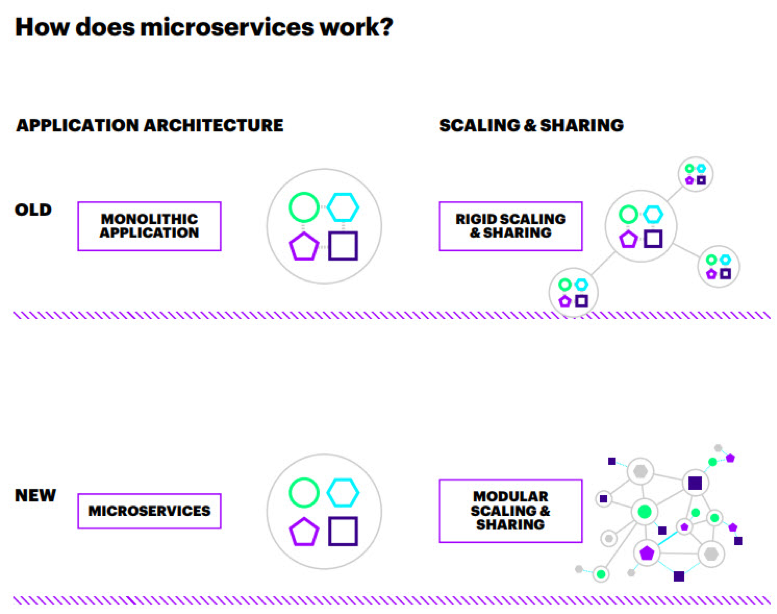

To overcome this problem, life insures will need to make use of two different technologies: microservices and blockchain. Let’s deal with microservices first.

Microservices break the functions of computer software into simple, discrete services that can be quickly and easily modified or recombined. This delivers internal benefits like scalability and reliability, and provides a foundation for companies to forge partnerships quickly and seamlessly. Seventy percent of surveyed insurance executives say that their organization’s use of microservices will increase over the next year.

MetLife, the multiline, multinational insurer, has already reaped the rewards of microservices. With help from Docker and Microsoft Azure, MetLife is boosting its IT agility with microservices, despite IT legacy systems that date back as far as 30 years. Virtual machines in use dropped 70 percent through this program.

The other foundational partnership technology is blockchain.

A blockchain is a distributed ledger system that stores groups of transactions (the blocks) and links them using cryptography (the chain). The innovation is that no single organization owns the blockchain; it is distributed across a peer-to-peer network with redundancies and consensus mechanisms ensuring no one can manipulate the transactions.

A blockchain can be public, like Bitcoin, or it can be used privately or in consortia for enterprise use cases. One of its many use cases for life insurers is to act as a surrogate for trusted relationships in an age of more—and more agile—partnerships.

Blockchain makes it possible for life insurers to pursue broader networks, on-board new partners, or enter new ecosystems with a level of ease and speed impossible in the past. Early initiatives are targeting reinsurance because it is a complex but standard process for which process improvements directly yield value.

For example, Allianz is focusing on making catastrophe swaps simpler, faster, and more tradable by writing them on a blockchain platform, while Tokio Marine achieved an 85 percent reduction in the time it takes a shipper to receive an insurance certificate when it tested a blockchain-based marine cargo policy.

It is only a matter of time before the use of blockchain trickles down to life insurance. Eighty-four percent of surveyed insurers say that blockchain-based ledgers and smart contracts are reinventing the way they engage with new partners. Forty-six percent expect to integrate blockchain into their systems in two years or less.

This is why life insurers should be considering important questions about blockchain and microservices right now:

- Can we scale partnerships to get the most out of platform-based ecosystems? Re-architecting systems for partnerships is a big task. To start, pick an area of your business to create a technology-based partnership that aligns with your overall strategic direction. This is not just buying a new tool or service—it is creating the foundation for deep integration with your next set of partners.

- How will we embark on our blockchain journey? When, where, and how will your enterprise implement blockchain? While blockchain is in its infancy, it’s becoming clear that it will be a hallmark capability of tomorrow’s leading companies and the cost of entry to deploy smart contracts.

- Are we ready to embrace the speed and agility of microservices? Are our customers? Our providers? Keep in mind that microservices transformations can be done piecemeal. Start by looking at the parts of your organization that are of high value to current and potential partners. Determine which applications they use, how they use them, and use this to inform a transition to microservices. Make any new APIs as publicly accessible as possible.

Come back next week for a look at the future of intelligent, distributed systems in life insurance.

In the meantime, the full Tech Vision for Insurance 2018 report is

available here.