Other parts of this series:

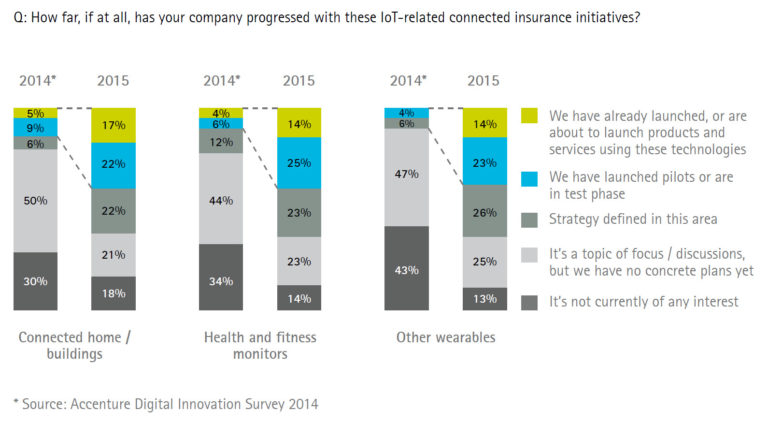

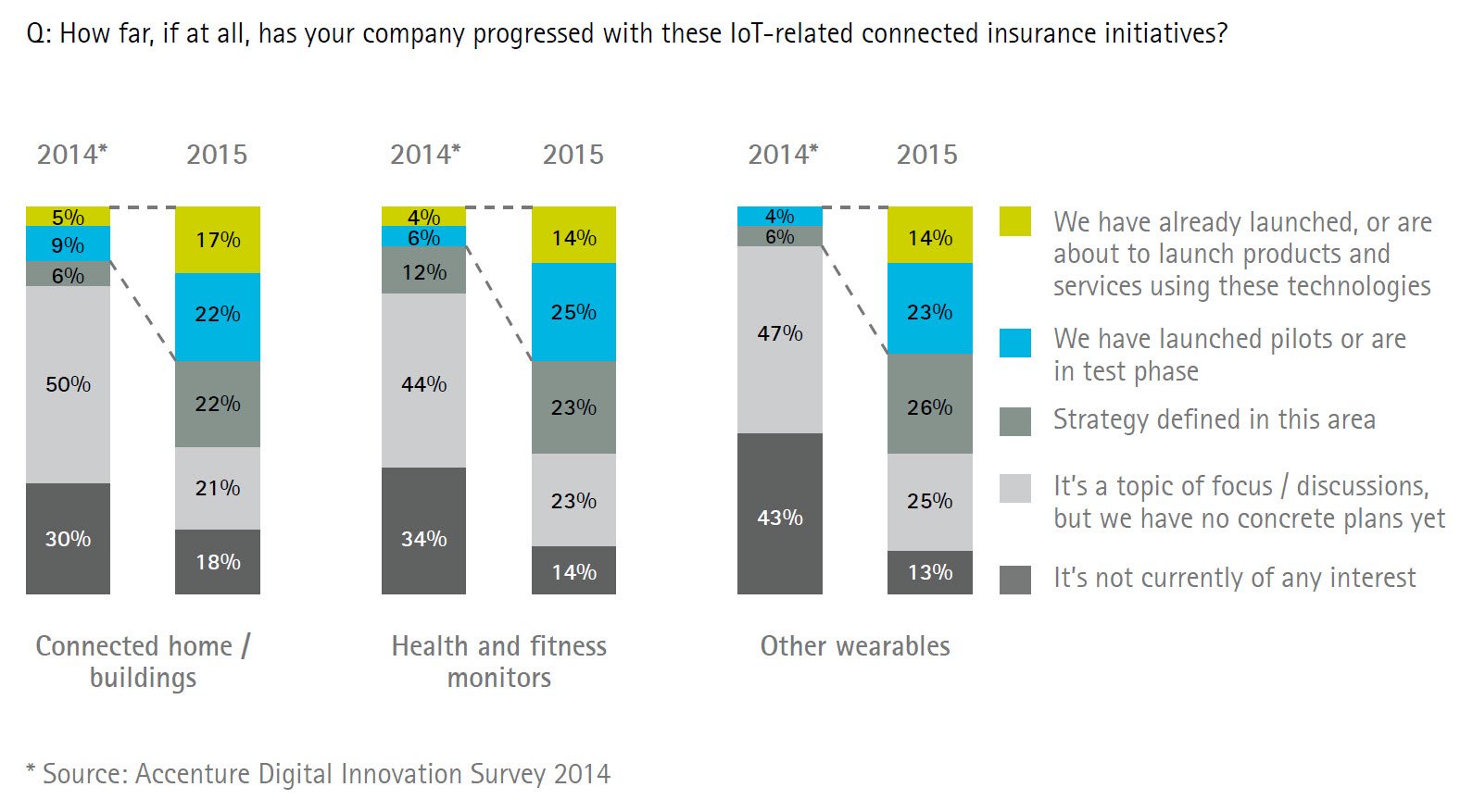

Respondents to Accenture’s Distribution and Agency Management Survey say that the next big game-changer in the insurance industry will be the Internet of Things. Over the last year, there has been a two- to three-fold increase in the number of IoT-related products, services and pilots focused on homes and buildings, health and fitness, and other wearables.

Life insurers are targeting the IoT as an unprecedented opportunity for growth. It offers huge potential for new personalized products and risk management services, and enables insurers to establish deeper, more intimate relationships with their customers.

When asked how, if at all, their companies have progress with these IoT-related connected insurance initiatives, 13 percent of life insurers have launched or are about to launch health and fitness monitors, and 14 percent are considering other wearables.

Embracing IoT is only one example of how forward-thinking life insurers can plunge into the future. Accenture recommends developing a strategy of active investment in new and emerging technologies and business models, and piloting programs with a fast-failure stra

tegy that allows innovation without fear.

For more information on what insurers are doing to improve their distribution systems, please look at blog posts by Erik Sandquist and read the study below.

Is your organization reinventing the role of your agents and distribution methods? Please contact me here so we can share your ideas, or email me to discuss how Accenture can help you accomplish these goals.

Learn more: