Other parts of this series:

The insurance industry across the world is beginning to experience enormous disruption as more and more carriers deploy powerful digital technology. And insurers need to ask themselves a big question: Are we going to benefit or suffer from this upheaval?

Companies that understand the potential of digital technology, and quickly realign their organizations to meet the challenges of a very different business environment, are more likely to thrive than fail. These firms are Digital Transformers. They’re overhauling their business models and rolling out new digital products and services that boost revenues and open new markets. They’re driving change instead of submitting to it.

We identified more than 100 Digital Transformers around the world during our recent Distribution & Agency Management Survey. We studied them closely to learn how they differ from other insurers.

So, what distinguishes Digital Transformers?

First and foremost, Digital Transformers have recognised that digital technology is going to completely transform the insurance industry. They’re investing in new technologies and new approaches to become more agile and innovative and to establish closer ties with their customers. This is a big shift for firms in the insurance industry.

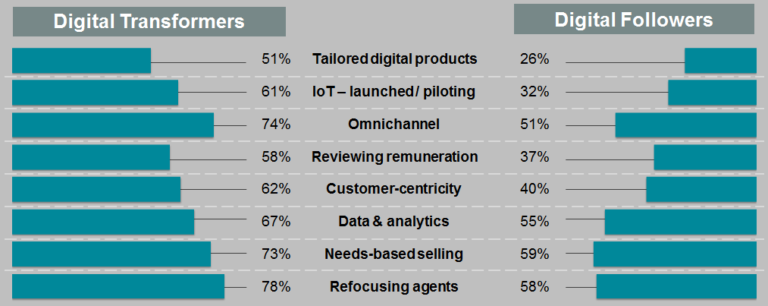

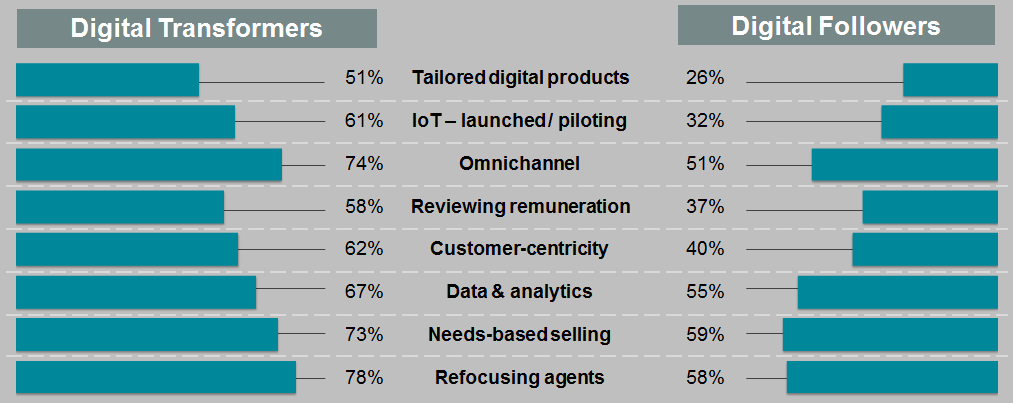

As you can see in the chart below, Digital Transformers are leading other insurers, Digital Followers, in implementing digital technology across almost all applications. They’re ahead, for example, in the move to customer-centricity and omni-channel distribution as well as refocusing sales agents and revising their compensation.

The second big differentiator? Speed. Digital Transformers have moved much more quickly than other insurers to implement digital technology. As many as 61 percent of the Digital Transformers we surveyed, for example, have launched or piloted solutions build around the Internet of Things. Only 32 percent of Digital Followers have done this.

These two big differentiators – insight and speed – are linked. Digital Transformers recognise that by moving quickly they can gain an early advantage in new digital markets that is difficult for rivals to emulate. The transition from Digital Follower to Digital Transformer is going to become increasingly difficult.

How should Digital Followers, insurers not at the head of the pack, respond? Our research has identified some key steps.

- Take action. Commit to the products, models and partners that will propel the organization into the digital era. The time for experimenting has passed.

- Put the customer at the heart of the distribution strategy. Product-focused sales processes can no longer meet the needs of customers who increasingly demand personalized digital services and experiences.

- Promote innovation throughout the organisation. Customer-centric innovation is the best defence against product commoditization and price competition.

- Take a strategic position in emerging ecosystems. A clear direction is essential to enable enterprise operations and architectures to be optimized for cross-sector integration and to gain access to key ecosystems and partnerships.

- Keep it simple for customers. Identify and eliminate the causes of friction in the customer experience across all distribution channels.

- Broaden the business. Apply digital technologies to move beyond indemnification into new markets such as real-time protection and risk-management.

- Refocus agents. Deploy digital technologies to perform routine and repetitive tasks and assign agents to higher-value activities such as building customer relationships, providing advice and cross-selling.

The disruption of the insurance industry triggered by digital services has only just begun. It will accelerate as insurers increasingly innovate and more firms, offering new solutions and practices, enter the market. Enormous change is certain. Carriers must decide now whether they will strive to benefit from this transformation. Those that wait risk being the casualties of change.

Next, I’ll start a new blog series that focuses on what I believe is one of the “Holy Grails” of insurers: pervasive personalization.

For more information about Accenture’s Distribution and Agency Management survey follow this link: www.accenture.com/InsuranceDistributionSurvey