This video explains why it may be more advantageous to borrow against your banking whole life insurance policy rather than take a withdrawal. It also explores …

This video explains why it may be more advantageous to borrow against your banking whole life insurance policy rather than take a withdrawal. It also explores …

As a loan, The whole Life insurance policy can not compete with banks at this low interest rate environment. However, as savings account it can. Whole life insurance policy loans are usually at 5% at this time. So, that defeats the purpose of allowing the cash value accumulate without a cost. Actually, the Whole life insurance loan interest rate is higher than the dividend the company produces. Therefore, It is not wise to get a loan from the life insurance company; unless you wouldn't qualify for a conventional loan with a bank- like a mortgage loan. Another aspect is the taxes that can be deducted of the interest when taking a bank mortgage loan, for example. On the other hand, you can not deduct policy loan interest. I own a whole life insurance policy with a mutual insurance company for almost 10 years. I have taken policy loans and conventional loans, so I know what am talking about.

Doesn't all of this assume that when you take the loan against life insurance that you are getting a 0% interest rate? I was under the impression that you had to pay interest that doesn't go back into your account when you took a loan against it. If this is true what is the interest rate that they charge on those loans?

Great explanations. Thanks for posting this walk-through.

Absolutely take the 2% backed only by your signature and the car itself. You pay less interest and keep all your collateral capacity intact with the policy. You know you can knock out the loan at any point with your cash value. But why would you if your cash value is growing by more than 2% and you can still borrow against that if an emergency or opportunity comes up? Some agents try to sell the "magic" of the policy loan itself, but it's just not the case.

Great video Hutch. Can you please make one comparing taking a policy loan to buy a car vs financing a car outside the policy. My credit union offers car loans at 2% and you can often get lower interest rates. In these situations, is it still better to take a policy loan at a higher rate or even sending extra interest into your policy? Thanks again!

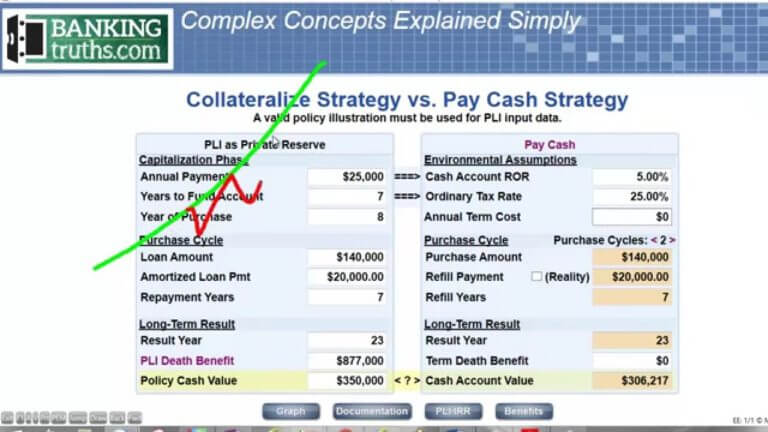

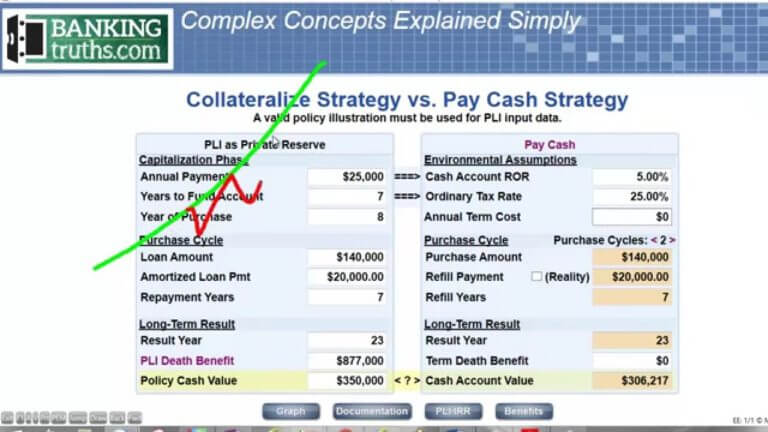

We are considering loan interest in the scenario. The unpaid loan interest is actually reducing the net cash surrender value that is being displayed. If we paid the loan interest in the scenario, then the net cash value would be considerably higher. We chose to not pay the interest in the life insurance scenario to compare it to saving/spending/saving cash. Since people don't replenish their savings with the interest their spent savings would have earned, we wanted to keep the cash flows in the life insurance scenario the same. So we simply had the rolled up loan interest eclipse some of the cash value.

Love the video, quite possibly the simplest and shortest explanation in existence on this strategy. What software are you using to calculate the two examples Hutch?

Awesome job breaking this concept down the proper way Hutch. This has to be the best video on the subject I've run across and I've seen many. Its clearly explained, backed up by good number crunching, and you're not making over reaching assumptions. Most often the Bank on yourself or infinite banking concept is explained with abstractions and not properly reinforced with concise and realistic hypotheticals. Have you done any detailed analysis to compare how this concept application would work with a Whole life vs IUL?