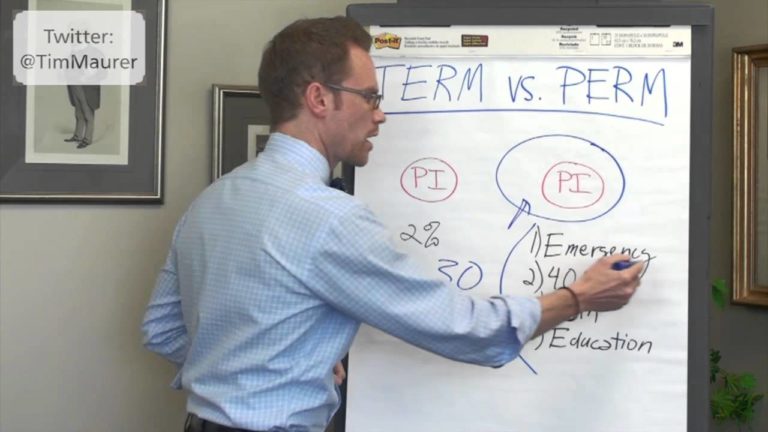

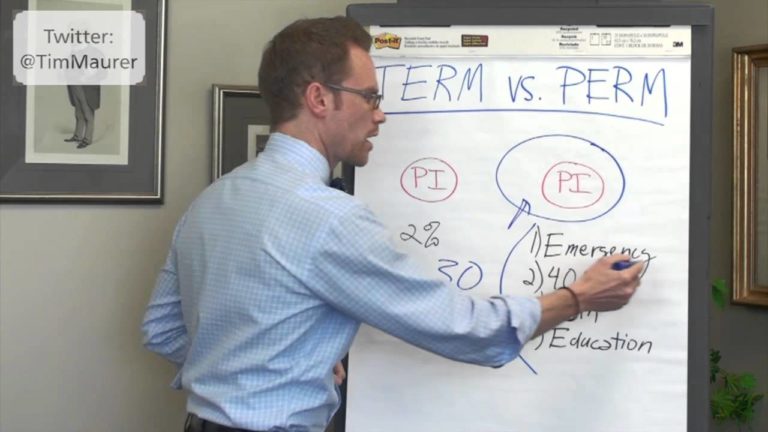

Tim Maurer is a financial planner, educator and author in Baltimore, Maryland. He also tends to be a little verbose. So I challenged him to attempt to sum up a …

Tim Maurer is a financial planner, educator and author in Baltimore, Maryland. He also tends to be a little verbose. So I challenged him to attempt to sum up a …

If you'd like to dedicate (slightly) more than 90 seconds to the topic, here's an article I wrote for +Forbes: "10 Things You Absolutely Need To Know About Life Insurance": http://timmaurer.com/2016/01/09/10-things-you-absolutely-need-to-know-about-life-insurance/

This is a 90 second clip why he likes Term Insurance and I couldn't agree more with him. He never said once there is no place for permanent, just have your ducks in a row before offering it.

this video was awesome keep up the good work it really helped me thank you

This was a very very helpful starting point for me. Please make more videos.

90 seconds of blanket statements without any real exploration, sounds like a bad idea. I am a little surprised that any financial planner would agree to something like this, even more surprised that they would video tape it and then post it on the web. This is not a personal attack. I am just a bit puzzled that any professional financial services person would make general recommendations on complex personal financial issues in just 90 seconds. The complexities really should be explored. I question whether or not these topics can be justifiably tackled in 90 seconds, and without a deeper analysis should recommendations be given?

Maxing your deferrals to a 401(k) for 30 years, and then losing 35 to 40 percent of what you have accumulated during a market correction, does not sound like a value added proposition to me. In fact, if you have been actively participating in a 401(k) for let's say the last 20 years, you would have experienced two such occasions where your losses were upwards to 40% (one in 2000 and the other in 2008). After the 2000 correction, it took seven years for the market to gain back it's 2000 highs, only to turn around and lose them all in 2008. It then took the market 5 years to gain back the 2008 highs. What about the thousands of people that were due to retire during those corrections? Defensive investing would have been far more prudent. Furthermore, Tim doesn't even address the tax consequences during distribution. Every dollar that goes into a 401(k) is taxed on the way out. That includes your gains. Essentially, you are being taxed on the harvest (I would much rather be taxed on the seed, or not taxed at all). Depending on your tax bracket, you could receive upwards to a 30% haircut. If you should die prematurely, your beneficiaries will inherit what has been accumulated plus the tax burden.

I would argue that a properly structured cash value policy from a participating life insurance company, should be considered as an asset class. You will get cash value growth plus dividend growth. These policies are structured for cash value accumulation and their performance can be pretty attractive. First and foremost, they are guaranteed. Secondly, by contract they go up in value each and every year. Thirdly, they provide a tax-free exit (tax free access to your cash value through policy loans – If the insurer is a non-direct recognition company, you can take out policy loans without affecting the cash value accumulation within your policy. Essentially, you are borrowing from the insurer and not your policy). Finally, they are self-completing. If you should die prematurely, you heirs will receive a leveraged death benefit, Tax Free! And if you become disabled, with the proper rider the insurance company will pay the remaining premiums. This is a stress test that none of the above mentioned assets can meet.

This is not to argue for a cash value policy over a term policy. They both have their place depending on the needs of the policy holder, and their long term objectives. Furthermore, I am not suggesting that you purchase a permanent policy in lieu of participating in your 401(k) or some of the other assets suggested by Tim. But it might make sense to reposition some of your assets into a vehicle with guarantees. For example, you could defer up to the company match, and invest the difference in a participating cash value policy with paid-up additions. Can you think of a safer fixed asset, that has the built in guarantees and a leveraged death benefit?

Whatever.

So that means 98% of people are going to be paying into something that they will not benefit from. Permanent pays out 100% of the time, right?

I get Term Life Insurance.

great video

Great video…and as a life insurance agent I mostly agree with you. All advisors should look at clients big picture needs.

I agree with this for the most part, but I would change the order of importance to:

1.) Get term insurance or see #5 if 1-4 are satisfied.

2.) Meet your 401(k) company match

3.) Meet your cash reserve need

4.) Max fund a Roth IRA (if eligible)

5.) Consider permanent insurance

6.) Max fund your 401(k)

7.) Meet education saving goals.

What do you think of the demos.org report on the excessive fees in 401k plans? It seems like the costs in life insurance you refer to go down as the wealth accumulates compared to a 401k. Ed Slott advises getting rid of your silent partner (the IRS) as you build up savings. Your thoughts?