http://www.IronsFamilyInsurance.com Or Call: 602-573-4198 Get affordable Texas health insurance that provides: -100% Coverage for Dr. Visits -100% …

Affordable Texas Health Insurance | Affordable Health Insurance in Texas

Sbi Life Insurance | Poorna Suraksha

Sbi Life Poorna Suraksha is a unique term insurance plan with two inbuilt riders : (i) Premium waiver (ii) critical illness benefit This term insurance policy covers …

How to Renew After Expire Vehicle Insurance

In This Video I Show You About how to renew after expired vehicle insurance . So Watch This Video and If you like this video please like & If you have any doubt …

Back to School | School after Lockdown | Short movie for Kids | #Funny #Kids RhythmVeronica

kidsstoriesinhindi #moralstory #rhythmveronica It’s a short movie for kids where we see School after Lockdown 🙂 Kids are back to …

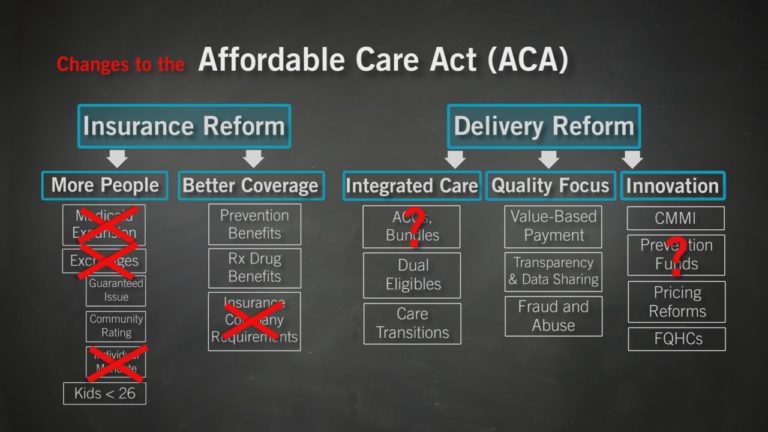

ACA and AHCA: Don Berwick Breaks It Down

Health care has taken center stage in the last few months in the United States. From debates on Capitol Hill, to town hall meetings, to non-stop media coverage, …

Term VS Permanent Life Insurance

Term, Permanent, Whole Life, Universal Life, Participating, Variable, Joint. There are so many variations of life insurance that it can become extremely confusing, …

Hurricane Checklist: How to Prepare for a Storm

Each year, certain parts of the country experience some kind of extreme weather. From hurricanes to tornados, these natural events are not only life-threatening, but they can also cause serve damage to your home and property. Depending on where you live, it’s essential for you and your family to be adequately prepared for hurricane season. Not sure how to prepare? Here are a few important steps to take before a storm hits.

1. Create a Hurricane Emergency Plan

Having an emergency plan is essential if you live in an area prone to hurricanes. Understanding what steps you and your family will take in the event of a storm will help you stay calm should you be ordered to evacuate.

To develop your emergency plan, first locate where you and your loved ones will go if instructed to evacuate. Your city may already have designated shelters in place for severe weather storms. You could also choose to stay with relatives or friends if they’re nearby and out of the danger zone. Regardless of where you decide, be sure to map out multiple routes, as storms often affect roads and transportation.

2. Prepare a Hurricane Emergency Kit

If ordered to evacuate, your priority should be to leave your home safely and as quickly as possible. To prevent unnecessary time trying to scramble essentials together, we recommend having (and regularly updating) an emergency kit that you can quickly grab and take with you. Your emergency kit should include the necessities required to live without electricity or running water for at least three days. Here are a few basics to include in your emergency kit:

- A portable radio

- Two flashlights

- Extra batteries

- Shelf-stable food

- Bottled water

- Basic first aid supplies

- Prescription medicine (if applicable)

- Pet food (if applicable)

- Basic hygiene items

- A whistle

- A charged phone and backup battery

- Basic tools (wrench, pliers, hammer)

- Duct tape, plastic ties, and garbage bags

- Local maps

- Change of clothes (include rain gear)

3. Review Your Insurance Policies

Before the start of each hurricane season, it’s best to review your insurance policies to verify your coverage.

A typical homeowners policy helps with repairing structural damage to your home, but it will not provide any protection against flood damage. In this case, you’ll need to purchase flood insurance. Keep in mind that some flood insurance policies require a waiting period of up to 30 days, so you’ll want to ensure you’re covered before a storm is announced. To avoid any delays, be sure to call your insurance agent to verify your coverage before a hurricane hits your home.

If you rent or own a condo, your renters or condo insurance will cover your personal property inside your unit. Your HOA or landlord’s insurance will typically cover the building itself.

Don’t forget to review your auto insurance as well, especially if you’ll be leaving any vehicles behind after evacuating. To cover the damage done by a hurricane, you’ll need to have comprehensive coverage.

4. Secure Your Home

While preventing a hurricane from reaching your home is impossible, there are ways to limit potential damage. So, here are a few ways you can secure your home if a storm is on its way to you.

- Trim or remove dying trees that may damage your home if they fall.

- Bring lightweight objects and outdoor furniture inside to limit potential projectiles.

- Anchor down objects that are too big to bring indoors.

- Reinforce your home’s doors and windows with plywood.

- If you have a two-story house, store valuables upstairs.

- Unplug all appliances and electronics.

5. Keep Inventory of Your Household Belongings

If it’s been announced that a hurricane will pass through your city, it’s best to have a record of your personal property. That way, if you end up having to file an insurance claim, you’ll have a list of items that need to be replaced. As with any claim, providing your insurance provider with this information as soon as possible can help speed up the claim process.

To create your inventory, go through each room of your house and list your items on a spreadsheet. For valuable items, be sure to include photos as well. Keep this spreadsheet readily available online and update it each year before the start of hurricane season.

6. What to Do During a Hurricane

If you find yourself in the middle of a hurricane, it’s essential to understand what to do. Finding protection from the wind and rain should be your first priority. Be sure to avoid windows and seek shelter in an interior room.

If the building you’re in begins to flood, attempt to reach the highest level of the building, but never climb into a closed attic. Doing so may cause you to become trapped by rising water. Finally, you should never attempt to walk or drive through flooded roads during a storm.

AIS Can Help Keep You Covered

Whether you’re preparing for your first hurricane season or looking to increase your coverage, AIS can help. Our team of knowledgeable insurance specialists will guide you through the process and help find you the best combination of coverage and price. To learn more about property or flood insurance for protection against hurricanes, give us a call today at (888) 772-4247.

The information in this article is obtained from various sources and is offered for educational purposes. Furthermore, it should not replace manuals or instructions provided by the manufacturer or the advice of a qualified professional. No warranty or appropriateness for a specific purpose is expressed or implied.

Study: Florida ranked 2nd-highest for auto insurance costs

Florida drivers are spending a larger portion of their salary on car insurance than just about everyone else in the U.S..

Tractorpulling FAIL Compilation!! #4

Disclaimer – Under Section 107 of the Copyright Act 1976, allowance is made for “fair use” for purposes such as criticism, comment, news reporting, teaching, …

Ginuwine – Differences (Official Video)

Lyrics: My whole life has changed Since you came in, I knew back then You were that special one I’m so in love, so deep in love You made my life complete You …

Business Insurance Non-Renewal: What Should I Do?

When your insurance company decides to non-renew your business insurance policy, it’s understandable to wonder what went wrong. You may ask yourself, what does it mean? Why did it happen? What can I do? Luckily, we compiled a list of answers to the most common questions that arise from receiving a non-renewal notice from your insurance provider here.

How Does A Non-Renewal Work And When Can It Happen To Me?

It’s important to understand that a cancellation notice of your business insurance policy is significantly different from a non-renewal notice. The most common reasons why an insurance company would cancel your policy are if you failed to pay the premium or if you have misrepresented yourself on the insurance application. In most states, insurance companies must give you a written notice of cancellation at least 30 days before canceling your policy.

Non-renewal is a different matter. Close to the end of your insurance term, your insurance company will decide whether they will offer to renew your policy at the same rate, adjust your rates, or not renew your policy. If your insurance company has chosen to non-renew your policy, it must send you a written notification and explain the reason for not continuing your policy a set number of days before your current policy ends. This is to provide you with enough time to find a new coverage for your business.

Why Did My Insurance Company Drop My Business Insurance?

Just as your insurance company may cancel a policy, they might also choose not to renew one. Below are several reasons why your business insurance policy was not renewed:

1. Excessive Claims

All insurance companies know that paying claims is part of their business. However, when a business has filed frequent claims, it may no longer be in alignment with its insurance company’s appetite. Even if they may be in good standing and pay their premiums on time or if the damage was unintentional, insurance companies can’t afford to pay out too much in claims.

2. Change of Appetite

Insurance companies often like to write specific types of business or “appetite.” Insurance companies favor these lines of coverage or particular industries or operations because they may have a lower risk of filing an insurance claim. However, sometimes an insurance company may not fully understand everything an industry does and once they do, they reconsider their guidelines or appetite.

3. No Longer Wants To Sell Insurance In a State

A non-renewal might also occur purely because a company stops offering a specific line of coverage or geographical region. If an area is prone to natural disasters like wildfire or hurricanes, it could be too costly for an insurance company to do business there.

What Should I Do After Getting a Non-Renewal Notice?

Don’t fret – A non-renewal doesn’t necessarily mean you did anything wrong, nor does it mean you won’t be able to find insurance for your business. Here are the steps to help you navigate these uncertain times.

1. Find Out Why The Non-Renewal Happened

You should immediately contact your insurance company to investigate why you were dropped and if there is anything you can do to reverse the non-renewal. If there is nothing you can do, find out if your insurance company or broker has a plan in place to find replacement coverage for you.

2. Get Your Loss Runs

Do yourself a favor and get a copy of your loss runs even if you have never filed a claim for your business. Loss runs are documents that give a snapshot of your company’s claim history. Insurance companies need to know if you have any prior claims when you obtain new coverage after a non-renewal has been issued.

3. Start Shopping For Insurance

Switching insurance companies will probably be a frustrating process as it can take up much of your time to find a suitable carrier. Luckily, our team of licensed business insurance specialists can help you navigate through this fickleness and assist you with finding the best coverage possible for your company.

Let us take the stress out of finding affordable business insurance so you can focus on your business. Speak with one of our Commercial Insurance Specialists today at (855) 919-4247 for a quick and easy free quote.

The information in this article is obtained from various sources and offered for educational purposes only. Furthermore, it should not replace the advice of a qualified professional. The definitions, terms, and coverage in a given policy may differ from those suggested here. No warranty or appropriateness for a specific purpose is expressed or implied.

Understanding 5 Types of Car Insurance Coverage

Understanding the 3 5 or even 12 types of car insurance coverage goes slightly in more depth about what deductibles and …

Aetna PPO Health Insurance Plans – Compare to over 180 Com

http://www.GetHealthQuotes.net Aetna PPO Healthcare Insurance – Compare Aetna PPO to 180 health+ insurance companies. Get free quotes!

Vlad and Niki – new Funny stories about Toys for children

Vlad and Niki – new Funny stories about Toys for children – compilation kids videos Please Subscribe! Vlad and Niki Merch https://vladandniki.com/ Download …

Get Auto Insurance Quote – Compare to Allstate, State Farm, Geico

Click Here——- http://3ainsurancequotes.com ———Click Here Are you paying too much for insurance? We can help you find an answer to this question.