Shop the cheapest NJ health insurance plans for individuals and families and save money. Instantly compare prices from the top companies in The Garden State …

Affordable New Jersey Health Insurance – Compare Rates

Arshad Warsi fools a cop | Sunday | Movie Scene | Comedy

Instead of giving bribe to a cop Arshad fools the cop and takes money from him. For Mobile Downloads Click: http://m.erosnow.com To watch more log on to …

Decreasing Term Life Insurance – Decreasing Term Life Insurance Review

Decreasing term provides a death benefit that declines over the life of the “term”. This means that the decreasing cash benefit corresponds to the decrease need …

How to lower Geico insurance rates in 2022

If you want to lower your Geico insurance rates you will need to know what options are offered for discounts in 2022. In this video I …

Learn colors for kids and numbers for children with Helper Cars! Cars cartoons for babies.

Watch cars cartoons for babies and learn colors for kids and numbers for children in English with Helper Cars! Today Helper Cars …

Florida's seniors weigh Republican health care plans

Nearly a quarter of Florida’s population is 60 or older, retirees who have made the Sunshine State their home. Often politically conservative, seniors …

Why Cash Value Life Insurance | Insuring Your Money Far More Important Than Traditional Investments

Why Insurance | Insuring Your Money Far More Important Than Traditional Investments Website: https://www.myMPI.com Schedule A Call With An MPI™ …

Best Credit Card Processing Companies For Your Small Business

Whether you own a brick-and-mortar or e-commerce business, accepting card payments is essential to succeed in this digital world. In 2021, cash was used in just 20% of overall transactions, down from 31% in 2017. But how do you choose which credit card processing company is right for your business? We researched dozen of reputable merchant providers and came up with our top five processors who are PCI-compliant, accepts all standard credit cards, and offers multiple services. Check out our top picks to find the best credit card processor for your business.

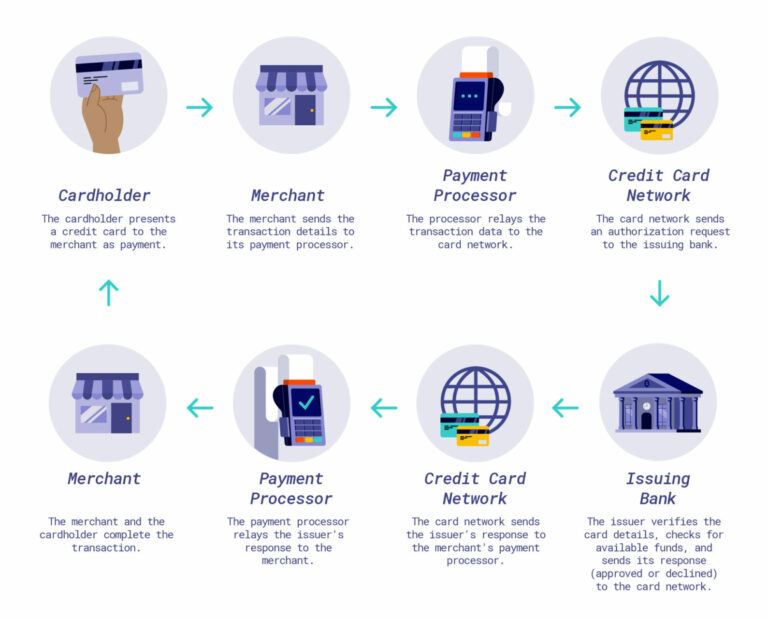

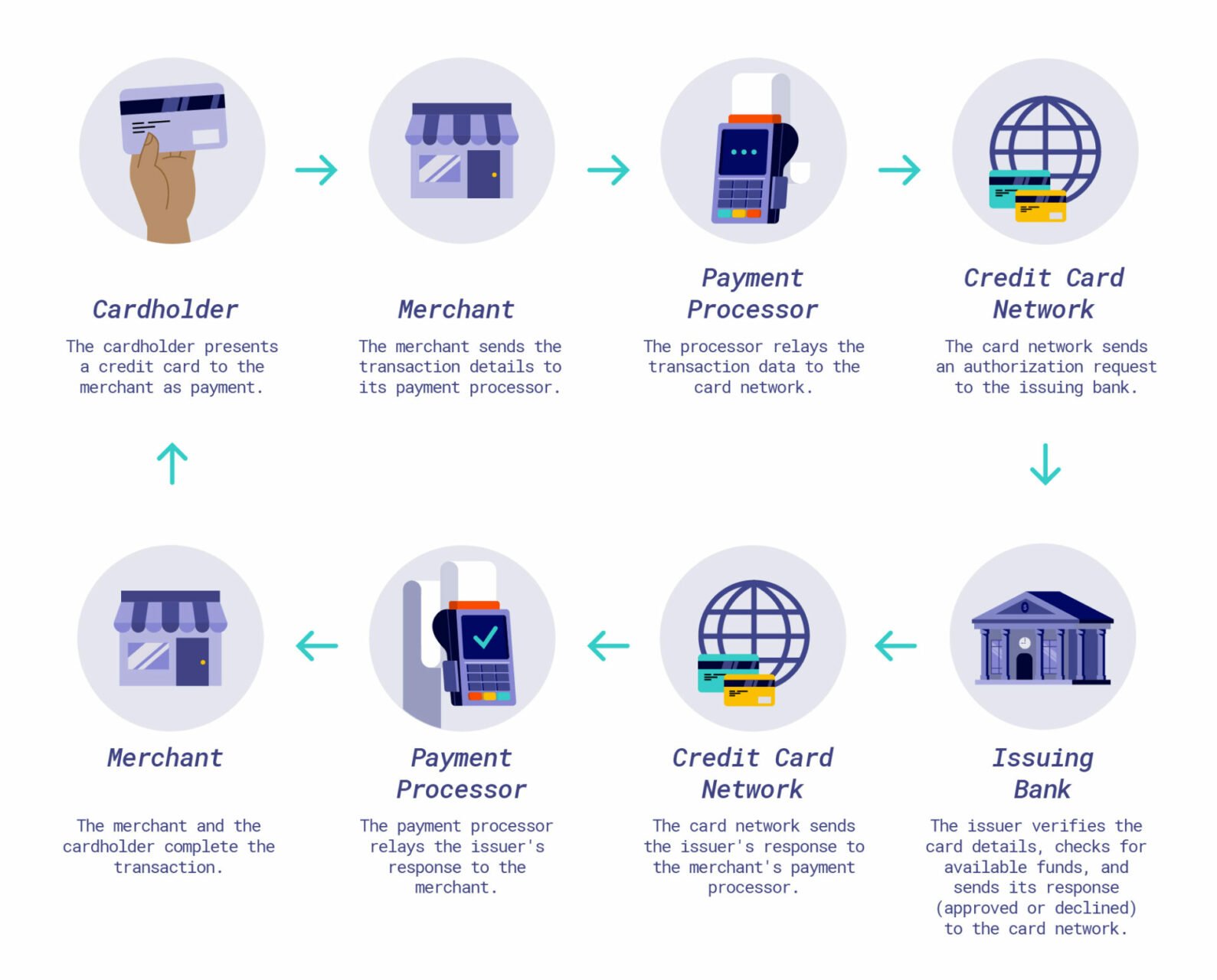

What is a Credit Card Processor?

A credit card processor, or a payment processor, is a company that facilitates the electronic transfer of money from a customer’s credit card to a merchant’s account. In other words, the processor acts as the middleman between the customer’s credit card company and the business taking the payment. Not only does the company authorizes, collect and transfer the funds, but it can also check for fraud, provide security, and handle charge disputes for you. Here’s what the process looks like:

Credit Card Processing Fees and Costs Explained

Every time a business accepts a credit card payment, they are required to pay a processing fee. There are three primary fees associated with each transaction, and fees can vary depending on the type of credit card accepted and which credit card processor you use. Knowing each fee can help you understand your options and decide the best payment processing service for your business.

1. Interchange Fees: Set by Visa, Mastercard, Discover, and other card brands, these fees are unavoidable and generally range from 1% to 3.5% of the transaction amount.

2. Assessment Fees: Also called transaction fees are also set by the card brands. These are flat per-transaction fees and typically range from 1 to 30 cents, based on the type of card and transaction.

3. Processor Markup Fees: These fees are what credit card processing companies charge for their processing services. Markup fees vary greatly from processor to processor, so it’s essential to shop around for the best deal.

4. Monthly Fees: In addition to markup fees, credit card processors charge monthly fees for specific services, such as statements, PCI compliance, and other processing hardware. These fees generally range from $0 to $500 per month.

5 of the Best Credit Card Processors

Choosing the best credit card processing company depends on what you need from a payment service provider and the costs to accept payments. Prices and services vary widely from one credit card processor to the other. Here’s a look at five credit card processors to choose from:

1. Square – Best Overall For Small Businesses

Square is a popular credit card processor amongst restaurants, retailers, and those just starting. It is extremely easy to set up and offers a variety of tools that can help businesses grow such as inventory management, sales analytics, and other marketing tools. In addition, Square provides a free credit card reader that works with its free app and a smartphone or tablet or you can upgrade to its Plus plan for $29+ a month and pay for a more robust POS system.

| Processing Fees | Hardware Cost |

| • 2.7% + 5 cents for in-person transactions • 2.9% + 30 cents for online transactions |

• First Square magstripe reader is free ($10 for each additional) • $49 for Square Reader contactless and chip card reader • $149 for Square Stand or Mount (Ipad not included) • $299 for Square Terminal • $799 for Square Register |

2. Stripe – Best For Online Businesses and In-App Payments

If you conduct most or all of your business online, Stripe should be a top contender. Stripe can integrate easily with hundreds of business software with Mailchimp or QuickBooks, while also offering its business solutions like Stripe Sigma to build reports or Stripe Billing for invoices. The company accepts a wide variety of credit card brands, both in-person and digitally, and over 130 currencies.

| Processing Fees | Hardware Cost |

| • 2.7% + 5 cents for in-person transactions • 2.9% + 30 cents for online transactions |

• $59 for Stripe Reader • $249 for BBPOS WidePOS E-card reader. |

3. Stax by Fattmerchant – Best for High-Revenue Businesses

Stax is perfect for businesses that process large volumes of transactions up to $500,000 per year. Instead of requiring a contract, Stax offers a monthly subscription starting at $99 a month with no markup on interchange rates. In addition to subscription plans, Stax offers optional add-on features like custom branding, digital gift cards, same-day funding, and a one-click shopping cart.

| Processing Fees | Hardware Cost |

| • 8 to 15 cents per transaction + interchange rate + monthly rate | • You can use a terminal of your choice but will need to purchase hardware elsewhere. |

4. Payment Depot – Best Credit Card Processor for Low Fees

With Payment Depot, customers pay a flat rate each month and low transaction fees. It does not have any setup fees, cancellation fees, or monthly fees nor does it have any markup fee on interchange rates. With plans starting at $49 a month, Payment Depot is the best pick for low fees and offers the biggest savings for businesses that process a high volume of payments.

| Processing Fees | Hardware Cost |

| • Basic Plan: $49 a month + 15 cents per transaction • Most Popular Plan: $79 a month + 10 cents per transaction • Premier Plan: $99 a month + 7 cents per transaction |

• Varies must request a quote |

5. Clover – Best for Specialty POS Needs

Clover is another great pick for small business owners whose top priority is flat-rate pricing, especially those in retail industries. Clover offers two pricing plans. Register Lite costs $9.95 a month and is best for businesses that have less than $50,000 in annual credit card sales. The higher-tier registered plan costs $39.95 a month and is geared toward merchants with more than $50,000 in annual credit card sales. With Clover, you can accept online orders and mobile payments, as well as create gift cards and loyalty programs.

| Processing Fees | Hardware Cost |

| • 2.7% + 10 cents for in-person purchases + monthly rate • 3.5% + 10 cents for virtual or card-not-present purchases + monthly rate |

• $49 for a handheld Clover Go card reader • $599 for Clover Flex mobile POS with the printer • $799 for Clover Mini POS |

Protect What You’ve Built

You’ve worked hard to build your business – protect it by having the right Business Insurance coverage. At AIS, we work with small business owners every day, finding insurance solutions to fit their needs. We know how much effort you’ve put into your livelihood, and we’re here to help you protect it when the unpredictable happens. Speak with one of our Commercial Insurance Specialists today at (855) 919-4247 for a quick and easy free quote.

The information in this article is obtained from various sources and offered for educational purposes only. Furthermore, it should not replace the advice of a qualified professional. The definitions, terms, and coverage in a given policy may differ from those suggested here. No warranty or appropriateness for a specific purpose is expressed or implied.

how to add rc in digilocker | how to to add vehicle insurance in digilocker #digilocker

Maine is video me Gari ki R C aur Insurance ko digilocker me Live Ad kar ke dikhaya hai. Download digilocker https://bit.ly/2wbD3UM #howtousedigilocker …

?????? ??????? ????? ??????????? ???????? ??? 2023

?????? ??????? ????? ??????????? ???????? ??? 2023

???? ?? ?????? ???? ?? ??? ??????? ? ???? ???????? ?????????, ??????????? ???????????? ? ?????????? ??????????? ?? ?????. ? ???? ???? ?????? ?????? ?? ????????? ????????????????? ????? ? ??????? ????? ??????????. ????????? ??????????? ? ??????? ?????????? ?????????? ??????????, ??? ?????? ?????? ????? ????????? ? ????? ????? ? ? ????? ?????.

????? ????????????? ??????????? ????????? ?????????? ??????? ?????????? ????? ??????????? – ?? ???????????? ????????? ??? ?? ???????????? ???????????. ?? ????? ???????? ? ? ?????? ???????????: ??? ????????? ??????????? ? ????????? ????????? ??????, ??????? ? ???????? ? ??????? ???????????, ?? ??????? ???????????? ????.

????? ????, ????????? ???????? ???????????? ? ?????? ?????? ?????????????. ?????????? ?????????? ???????????? ??????????? ? ?????????????? ??????????? ???????????? ??????? ??????? ?????? ?? ?????????????. ???????, ??????? ????????? ??? ????, ?????????, ??? ??? ????????????? ????? ??????????? ?????????? ???????????? ? ??????????.

??????? ?? ??????? ? ????????, ??????? ?????????? ????? ? ??? ???????? ?????????. ??? ???????? ?????? ???????? ???? ????? ?? ???????, ?? ?????? ???????????? ??????????. ??????????? ?????????? ? ????? ??????? ? ????????? ????? ???????????, ??????? ????? ???????????? ?????? ????.

??? ??????? ?????? ?????? ?? ?????? ? 2023 ????

????????????? ?? ?????????????. ??? ?????? ?????? ????????? ???????? ?? ??????????. ??? ???? ???????????, ??? ?????? ????????? ????????. ???????? ?????? ??????? ? ????????, ????? ??????? ????????? ???????????.

??????? ??????????. ????? ??????????? ???? ??????????????? ?????????? ?????????? ?????? ??? ???????. ???????? ???????? ?? ?? ????????? performances, ?????? ? ?????????. ??? ?????? ?????? ? ??? ?????, ??? ????? ??????? ???????.

??????????? ?????? ? ?????. ??????? ?? ?????????????, ??????? ????????? ???? ???????????. ?????? ?? ??????? ??? ??????? ????? ????????? ?????? ????? ?????? ??? ?????????????? ??????.

???????? ???????. ?????? ?? ?????? ??????? ????? ???????????? ?????? ?????? ????? ? ??????????. ??????? ?? ???????? ???? ????????? ? ???????? ?? ???? ????, ??????? ???????? ?????? ??? ???.

?????????? ????? ??????????. ?????????? ?????? ?????? ??? ????? ??????. ?? ?????????? ??????????????? ?????, ???? ???? ?????? ??????????????? ????????????. ??? ??????? ????????? ?????????? ????????????.

??????? ?? ????????? ???????????. ????? ?????? ????? ????????. ??????? ?? ?????? ??????????? ? ????????????? ???? ????????? ?? ???? ?????????????, ????? ?????????? ? ????? ????????? ???????.

????????? ? ??????? ????????. ????? ?????? ? ??????? ?????????????? ????????? ????? ???? ??? ???????? ?????? ? ???????. ?????? ? ?????????? ??????? ??? ????????? ???? ??????.

??????????? ???????????? ???? ????????. ????? ?????????? ?????? ????????? ??????, ??? ?????????, ? ??? ???. ??? ??????? ???????? ???? ?????? ? ??????? ? ??????? ????? ???????????? ????????.

??????????????? ????????? ? ??????: ??? ??????? ???????

???????? ????? ??????? ?????????? ????????? ????????? ????????-??????????. ??? ????????? ?????????? ??????? ? ?????? ?????? ?? ?????? ????????.

????????? ??????????? ?????????? ???????? ??????????? ? ?????????? ?????????, ??? ?? ??????? ????????????????? ? ?????? ? ??????? ????????. ??? ??????? ?????? ????????? ?????? ? ??? ????.

?????????? ????????? ?????????? ?? ????????? ?? ?????. ??? ?????? ????? ????????????, ? ?????????? ?????????? ? ?????????? ???????? ??????, ??? ??????????? ??????? ??????? ????????.

?????????? ?????????????? ?????????? ????? ?????????????? ??? ??????? ??????? ????????. ??? ???????? ?????????? ??????????????????? ?????? ? ????????????, ???????????? ?? ????????? ???????? ?????.

????????? ?????????????? ???????. ?????? ?? ??????? ????????????? ? ??????? ??????????? ? ???????? ???????, ??? ??????? ??????? ??????? ????? ????????????? ? ?????????????????.

?? ???????? ??? ?????????????????. ?????????????????? ? ???? ??????????? ????????? ???????? ?????? ????? ?????? ? ???????, ?????????? ???????????? ?????? ??????.

????? ???????? ????? ??????? ???????, ?????????? ?? ???????? ?????????? ?????? ? ???????????. ??? ??????? ??????? ????????????? ? ??????? ??? ???? ??????????.

???????????? ???????? ???: ???? ?????? ? ?????? 2023

????????? ?????????? ??????? ???????? ? ???????????? ?? ?????. ??? ???????????? ??????????? ? ?????????? ???????????.

??????????? ???????????? ?????????????? ??? ?????? ????????. ??? ????????? ?????????????? ??????? ?????? ??? ?????.

??????? ?? ?????? ???????? ? ????????. ?????????? ?????????? ???????? ?? ??????? ? ?????, ??????????? ?? ?????????, ????? ???????? ????????????? ???????????.

?????? ?? ????????????? ???? ? ????????? ?????. ????????????? ???? ?????? ? ?? ????????? ?? ????????.

????? ????????? ????? ???????????? ? ???????? ??????. ?????????? ???????????? ??????????? ???????? ??? ???????????? ??????????.

- ?????????? ?????????? ???????????? ??????????? ???????? ?? ???????????.

- ?????? ????????????? ????????? ??? ?????????????? ??????.

- ??????????? ?????? ???????????? ?????? ? ?????? ????????????? ???????.

?????? ???? ?????????????, ?? ??????? ??????????? ???????? ???? ????????????. ??? ?????? ?? ????? ??????????? ?????? ?????? ?? ????? ? ?????? ?????????? ???? ????????????????.

Life Insurance (LIC) Life Insurance Corporation Of India

Mohammed Abdul Javeed Life Insurance Advisor Feel Free To Call/Dm-7330542783 J.J Insurance Services Is The Broker Of Life Insurance Corporation Of …

Dirt Track Crash Compilation – 2019

There are a few clips in the video that were recorded before this year but a majority of them are from this year.

What is Renters Insurance and What Does it Cover?

One of the positives of renting is that you don’t have to worry about paying for building repairs or insuring the property. But what happens if someone breaks into your apartment and steals your laptop? Or what if there’s a fire and your furniture is damaged? Your landlord’s insurance won’t cover your personal property in these scenarios. To have the safety net you’re looking for, you’ll need renters insurance coverage.

What is Renters Insurance?

A renters insurance policy protects you and your personal property from unexpected events, also known as covered perils. Although not legally required, some landlords may request you carry renters insurance to rent their property. A standard renters insurance policy will typically include the following four coverage types:

- Personal property coverage – this coverage protects your personal belongings, such as your clothing, electronics, furniture, etc., from covered perils like theft, fire, and vandalism.

- Personal liability coverage – renters liability coverage will pay for third-party injuries or property damage you are responsible for.

- Loss of use coverage – loss of use coverage will pay for additional living expenses, including temporary housing if your rental home becomes uninhabitable due to a covered peril.

- Medical payments – if a guest injures themselves on your property, medical payment coverage can help pay for their medical expenses regardless of fault.

Additional Coverages

Aside from the four main coverage types above, there are also additional coverages you can add to customize your policy. Available add-ons can include the following:

- Scheduling valuable items – Your renters insurance will likely have a payout limit for valuables such as jewelry and electronics. To cover an item over this limit, you can add an endorsement to fill in any gaps in coverage.

- Water backup coverage – backup issues can cause problems to your rental home’s bathroom. Some insurers may allow you to add water backup coverage to provide some protection.

- Pet damage – if you’re worried about losing your deposit due to damage your pet may cause, ask if your insurer can provide a pet damage endorsement.

What Does Renters Insurance Not Cover?

Renters insurance can be flexible in what it covers. Still, there are specific situations standard policies won’t provide much protection against.

For example, most insurers won’t cover flood or earthquake damage. To cover damage to your personal property caused by floods or earthquakes, you’ll typically need to purchase flood and earthquake insurance separately. In addition, most policies will not cover pest infestations. These are considered a maintenance issue and therefore are not covered by most insurers.

Although renters insurance does protect your personal property, it will not cover your car if it is stolen or vandalized. In this scenario, you’ll need an auto policy with comprehensive coverage. However, your belongings inside the vehicle at the time of theft are covered by renters insurance.

Can I Share a Renters Insurance Policy with My Roommate?

If you live with others, you may wonder if you can save by sharing a policy with a roommate. While some companies may allow you to include roommates on a policy, the practice isn’t typically recommended.

For starters, you may not save as much as your think because renters insurance isn’t as expensive as other insurance types. In addition, various problems can arise when multiple people (with different personal property) share a policy. For example, let’s say your roommate files a claim. Even if you weren’t involved in the incident, you’ll still have a claim on your record that could affect your premium. Or, what if your roommate oversees payments and misses a bill, causing both of you to be uninsured?

To avoid potential issues, each roommate should carry their own policy.

How Much Does Renters Insurance Cost?

On average, a standard renters insurance policy can cost anywhere between $15 to $30 a month. However, rates can vary depending on your coverage needs and where you live. Some of the main factors that will determine your rate include:

- Your rental home’s location

- Coverage limits you select based on your personal property

- Claim history

- Liability protection limits

Like most insurance, your renters insurance policy will have coverage limits and a deductible. A standard policy will cover personal property for up to $30,000 and provide up to $100,000 in personal liability. Your deductible, or the amount you must pay out of pocket before your insurance steps in, can range from $500 to $1,000. Generally, a lower deductible will result in a higher premium and vice versa.

Get a Renters Insurance Quote

At AIS, our insurance specialists can help you find the coverage that best fits your needs. From auto insurance to renters insurance, our team is equipped to answer any questions and will guide you along the insurance marketplace. To speak with a specialist today, call (888) 772-4247, or start a quote online.

The information in this article is obtained from various sources and offered for educational purposes only. Furthermore, it should not replace the advice of a qualified professional. The definitions, terms, and coverage in a given policy may be different than those suggested here. No warranty or appropriateness for a specific purpose is expressed or implied.

Auto insurance rates going up nationwide

Kristin Lazar reports on how auto insurers in California are attempting to raise rates on drivers, despite the strong regulatory …

NY State of Health: Health Insurance Explained

Health Insurance Explained – The YouToons Have It Covered is a light-hearted treatment of a difficult and important topic, breaking down insurance concepts, …

Best LIC Policies in Telugu | Life Insurance |New Policies in 2021 | A S N Prakasa Rao | SumanTv

LIC #LICPolicies #SumanTv Welcome to SumanTV Money Channel, The Place where you are served with Online and Offline Money Making Tips and Money …