Voluntary benefits is a powerful growth engine that can generate solid revenue growth for life insurers—and in the process, strengthen the relationship between employers and workers.

According to a 2013 study by Eastbridge Consulting, the most popular products include life insurance (accounting for 28 percent of sales), disability (21 percent), dental (13 percent), accident (12 percent) and hospital indemnity/supplemental medical (8 percent).

But these are only the start. More non-traditional voluntary insurance products are increasingly in demand: vision, auto and home, long-term care, legal, pet, identity theft and financial wellness.

These products, which address customer vulnerability to life events that disrupt cash flow or fill health care gaps, have great sales potential. People need them at all stages of their lives, so insurers are only limited by their imagination in developing new offerings.

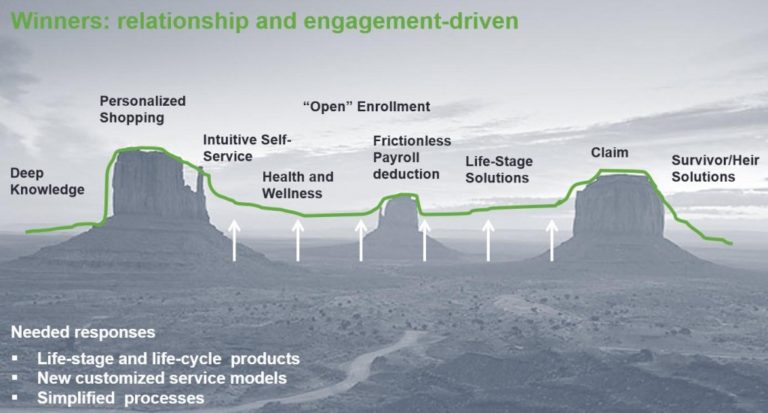

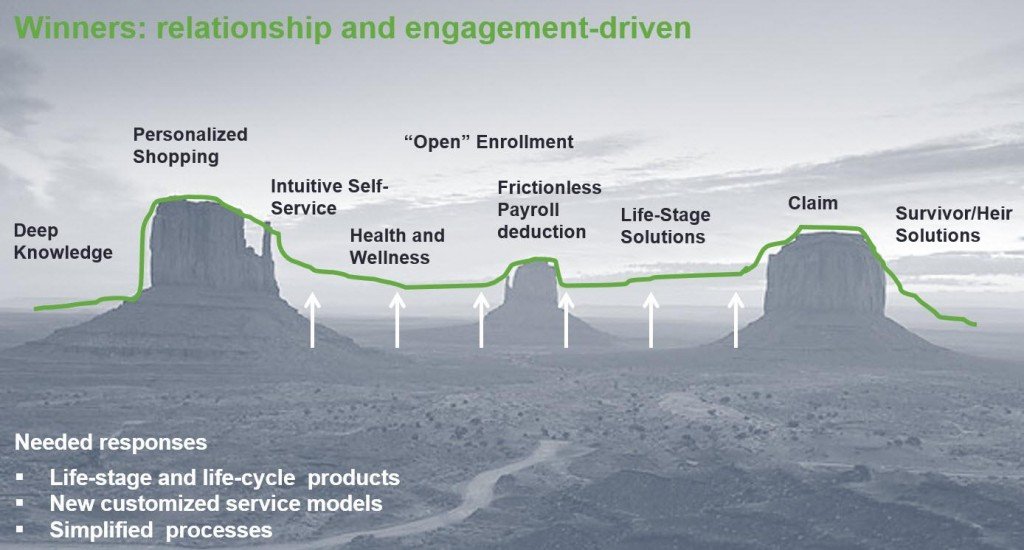

The chart below illustrates the lifecycle of the successful voluntary benefit product, and how it can serve the buyer throughout his or her life—and beyond, through engagement with the survivor’s heirs.

This type of intensive customer engagement goes far beyond what most of us think about voluntary benefits. Insurers with the most successful offerings are providing not just products, but “living services” strategies: life-stage and life-cycle offerings characterized by new customized service models and simplified processes.

Next time I’ll discuss how insurers can engage today’s digitally driven customers in developing and marketing these products.

Learn more:

Voluntary benefits: A strategy for capturing the underserved middle market