Other parts of this series:

Digital technology is triggering huge change throughout the insurance industry across the world. Many property and casualty insurers, as well as multiline carriers, are deploying this technology to radically transform their distribution networks. Traditional practices and methods are quickly being replaced by a host of innovative approaches that put the customer – not the product – at the heart of insurance distribution.

Life insurers have tended to be cautious in the face of such change. But they’re beginning to recognize the enormous potential of digital technology. They’re starting to overhaul their distribution channels. And they’re moving quickly.

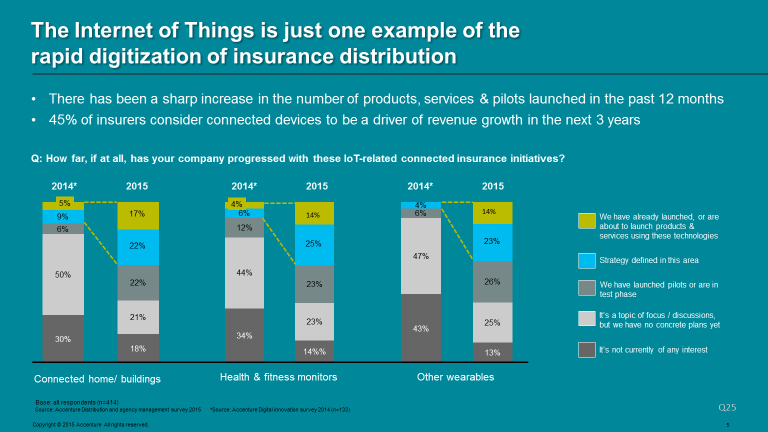

The Internet of Things (IoT) is one of the powerful new digital technologies attracting strong interest from life insurance providers. Our Distribution and Agency Management Survey reveals a big increase in IoT insurance products, services and pilot projects during the past year. As many as 45 percent of insurers expect these initiatives to drive revenue growth within three years. Our data shows that insurers are no longer limiting their focus to auto telematics applications. Instead, they’re addressing a much wider range of opportunities. They include connected buildings and homes as well as real-time health and fitness applications.

This is a global trend. We canvassed more than 400 top executives at big carriers in 20 countries, and as the graph shows, they reported a two- to three-fold increase in connected insurance initiatives over the past 12 months.

Life insurers are fuelling much of this growth and diversification. As many as 36 percent have introduced or tested a product that uses health or fitness monitors. And 30 percent have solutions, on the market or on trial, that incorporate other types of wearables.

Many life insurers still trail their peers elsewhere in the industry in applying digital technology such as the IoT. But they’re catching up fast. Front-runners such as John Hancock, Generali and Discovery are rolling out connected solutions that are not only improving the service they provide customers. They’re also opening up new markets. By gathering real time customer data, collected from wearables and other monitors, these companies are building successful health and wellness businesses capable of delivering strong long-term revenues.

Life insurance providers are likely to be at the forefront of the next wave of insurance innovators. Digital technology such as the IoT will enable them to deliver highly personalized products and services tailored to match the varied and changing needs of their customers. A host of new connected life insurance offerings are set to be unveiled in the year ahead. We’re heading for some exciting times in the life insurance industry.

In my next blog post I’ll examine some of the reasons life insurers have lagged other insurance providers in the shift to digital technology. Until then, take a look at our Distribution & Agency Management Survey. I think you’ll find it very interesting.

Reimagining Insurance Distribution: Insurers accelerate the shift to a radically different distribution model