Often times I am asked about the different pieces inside a life insurance policy. What is paid up additions or pua? How does the base insurance work? What is …

Often times I am asked about the different pieces inside a life insurance policy. What is paid up additions or pua? How does the base insurance work? What is …

You're jumping into a mid-range level of knowledge. You're not explaining anything to a beginner level. Cash value? You can take cash out of your insurance policy? Huh? That's nothing like any other kind of insurance. Maybe you should re-do this presentation and assume people know nothing about life insurance.?

I'm confused where does one find a permanent life insurance policy worth 500K??

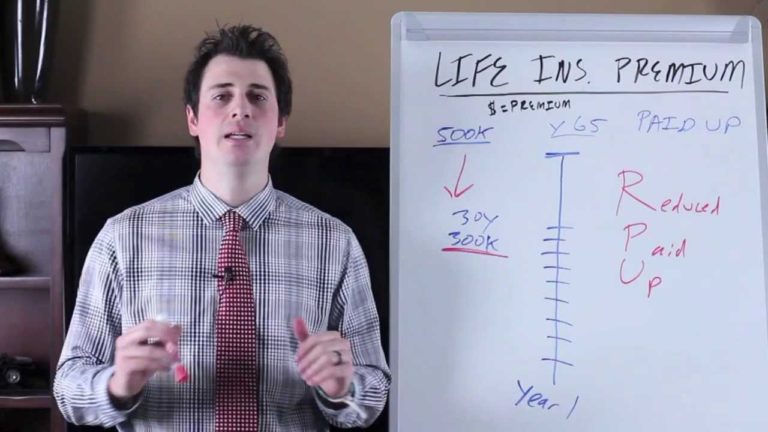

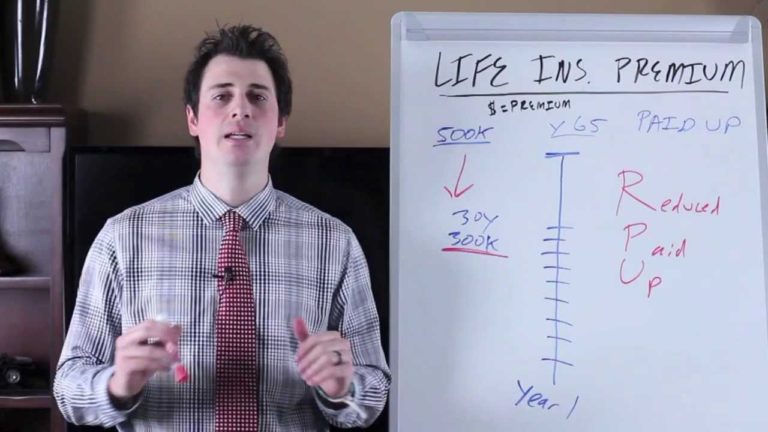

Great tutorial – simple language to understand..just to clarify, RPU benefit will be restructured to whatever the new death benefit pay-out will be at that stage? 300K in your example vs 500K??

Could you please explain where the other vehicles come to play on the chart? I understand the first vehicle and he pays the policy interest of $3306. but he keeps paying the $3306 a year in interest ?? how does he get the other vehicles?

New subscriber this is an outstanding video because I have an IUL policy and was just discussing about a week ago with my LI agent how to use the policy to purchase a used vehicle for about $10,000 and I bumped into this video!!!!

this is just great I can watch you all day …. easy to look at easy to listen to love it!!!?

Thanks for making this video Josh, this was very helpful.?

My mother opened an adjustable premium policy with New York Life Insurance and Annuity Corporation in 2002 with quarterly payments of $562.50. Lately, NYLIAC is asking for more money than the planned premium when the policy was initiated, and she is being told that if she does not send the amount her policy would lapse. I have done an analysis of her policy, and feel that the cash value is not being administered accurately. After 12 years, the cash value on her policy only came out to $8,813.26 without missing any payments. Your video was informative and I was able understand policyholders' options especially with your explanation regarding "Reduced Paid Up". Would you be able to recommend a life insurance professional to explain my mother's options??

What happens if your term life insurance expires, do you just get another one?