Other parts of this series:

“Insurance for you, not someone sorta like you.” The catch line belongs to U.S. insurer Esurance, an Allstate company. And it expresses well one of the biggest forces shaping the global insurance industry – personalization.

Esurance is among a handful of insurers that have recognized the power of personalization. They’re using digital technology to build closer relations with customers who are likely to generate substantial long-term revenue. Carriers that fail to personalize their products and services could find many of their customers turning to alternative insurance providers.

There’s no doubt that people want their insurers to know them better. Nobody wants to be treated as just a representative of a demographic group or a market segment. People want to be acknowledged as individuals with unique needs and preferences.

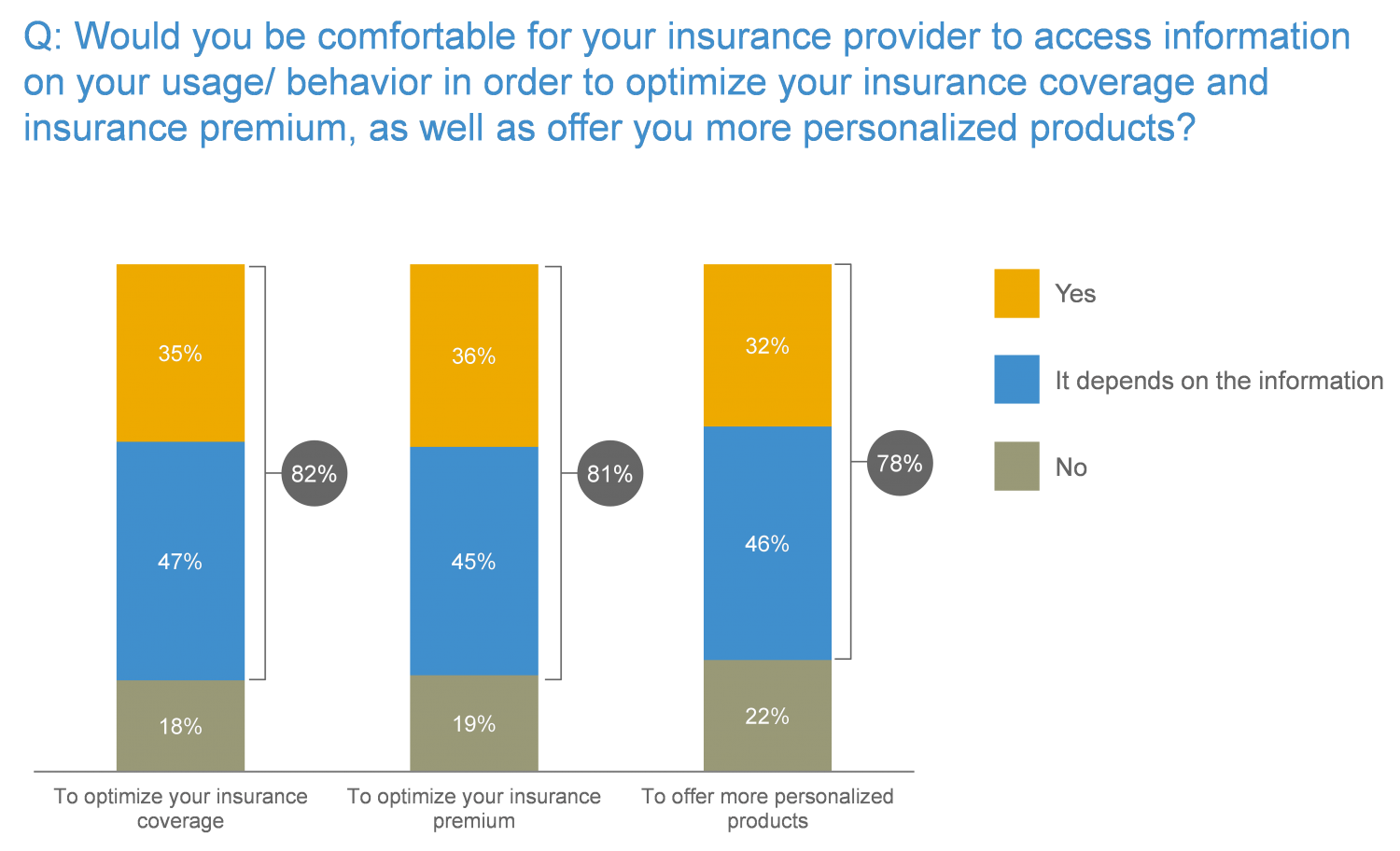

Just how much insurance customers crave personal attention is revealed in our Customer-Driven Innovation Survey.

It’s clear that customers don’t just want personalized pricing. They want personalized service. This includes easy access to the information they require and the ability to tailor their own insurance solutions. It’s no surprise that 72 percent of customers who are considering changing their insurer, identify personalized services as an important factor in their choice of an alternative. This is a global trend which is apparent across the 40 countries we surveyed.

Consumers want their insurance providers to recognize them, acknowledge them and constantly give them what they want. They’re looking for a relationship. And it’s difficult to have a relationship with someone who treats you like a stranger.

Google and Amazon, for example, have shown how digital technologies such as social media and analytics can be applied to track customer needs and preferences. They’ve used this information very successfully. The more information they gather, the better they’re able to refine their services to meet the wants and whims of customers. They’ve also built on these relationships and introduced new services likely to appeal to specific audiences.

Insurers are beginning to follow suite. Allstate subsidiary Esurance is a pioneer of online automobile insurance and recently introduced cover for homeowners. Its digital platform allows customers to use their smart mobile devices to manage their contracts, lodge and track claims and, by using a video link, chat to customer service representatives. Esurance also provides customers with an online comparison module, so they can check offerings from other insurers, and uses telematics technology to monitor the driving of its automobile policyholders. Extensive use of major social media channels further strengthens ties with customers.

Esurance’s investment in personalized digital services has already driven a substantial increase in premium revenue.

In my next blog, I’ll discuss how insurers can best gather information essential for successful personalization.

For further information read:

Satisfy the craving for insurance personalization