Other parts of this series:

Insurers throughout the world are recognizing the huge potential of the Internet of Things (IoT). And they’re preparing an array of products incorporating connected devices to hit the market in the coming year.

Development of IoT products has increased three-fold in the past 12 months, according to our recent Distribution & Agency Management Survey; a really impressive acceleration! Furthermore, 44 percent of the insurers we canvassed around the world believe connected devices will drive revenue growth in the next three years.

Many carriers are already committed to the IoT. More than 60 percent of the 414 insurance executives we contacted have already launched or piloted solutions that incorporate connected devices. This is a huge increase on last year. A similar Accenture survey, conducted in 2014, found that 78 percent of insurance providers then had no plans to launch IoT solutions.

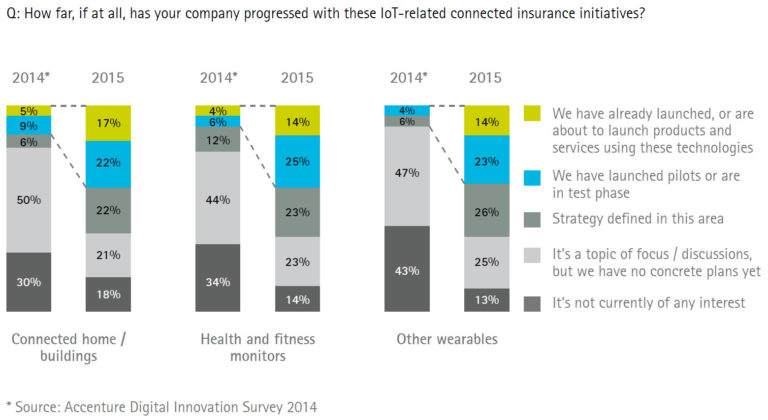

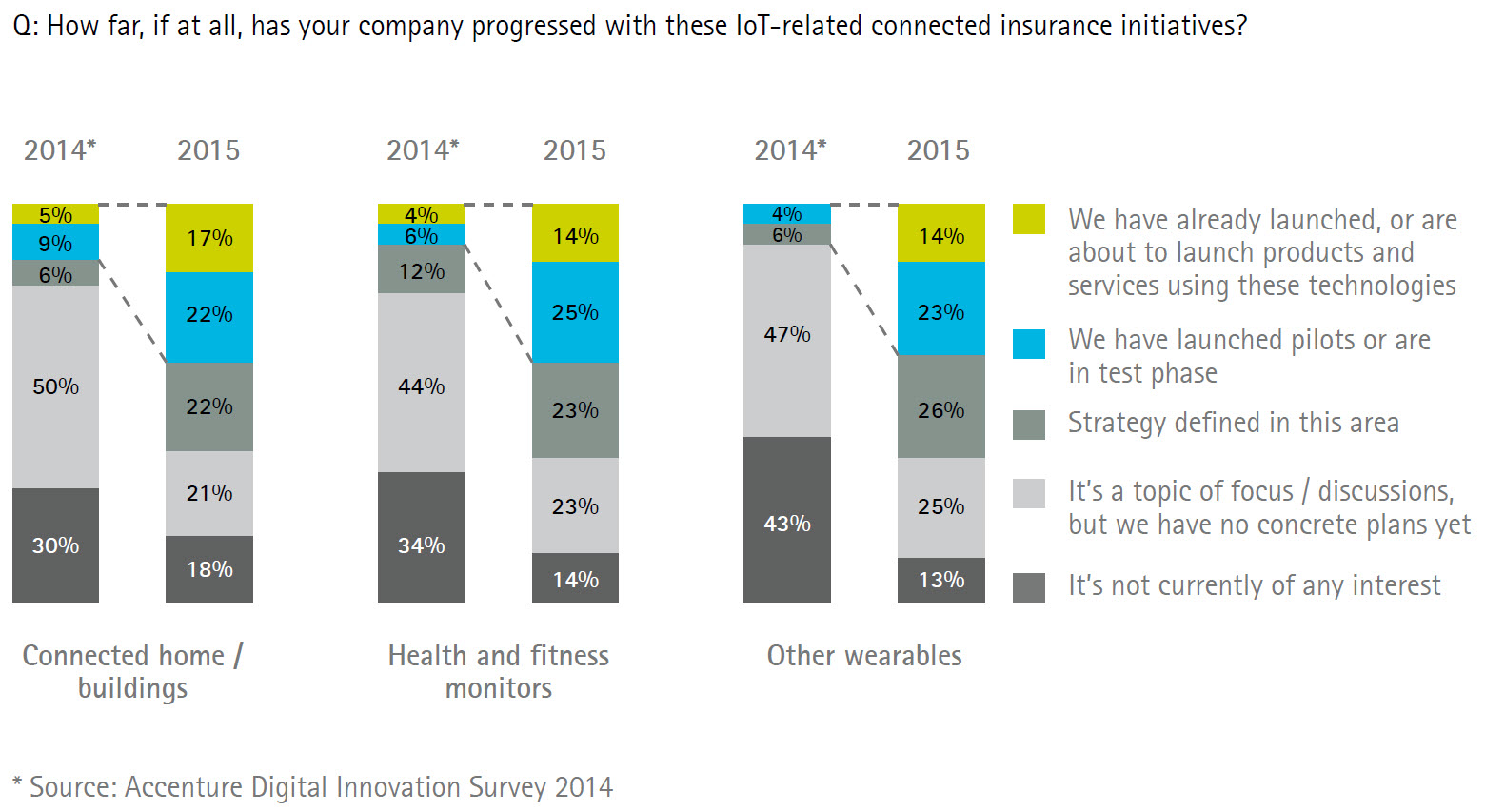

As you can see below, and this is also a big change from last year, insurers are taking advantage of the IoT in applications well beyond their initial focus on auto telematics. Around 18 percent of personal lines carriers worldwide have connected-building products on the market or ready for launch and 27 percent are testing such offerings. Life insurers are latching onto connected health and fitness monitors. While only 13 percent of these carriers currently market products that use these devices, a further 30 percent are busy with trials.

What’s causing such a turnaround? Carriers are realizing that the IoT offers an unprecedented opportunity to increase profits and capture new business. Also, it will enable them to climb the value chain. They’ll be able to help customers avert losses instead of only indemnifying them against the possibility of such events. In a market that is becoming increasingly commoditized, especially for automotive and home cover, this is a big attraction.

Moreover, the IoT will allow carriers to forge much closer relationships with their customers. Information gathered from connected devices gives insurers valuable insights into customer behavior and preferences. They can use this information to deliver further highly-personalized, better integrated, products and services that generate additional revenue. These services also provide the opportunity to communicate more frequently with their customers, with more positive messaging, than is the case with traditional insurance.

In Europe, and elsewhere in the world, the strategic implications of the IoT have pushed this technology onto the boardroom agenda. Introducing products and services based on IoT technologies is now one of the top two investment priorities for insurers. The other is improving data and analytics capabilities. The two technologies complement each other and provide insurers with far greater understanding of their customers.

In Europe, and elsewhere in the world, the strategic implications of the IoT have pushed this technology onto the boardroom agenda. Introducing products and services based on IoT technologies is now one of the top two investment priorities for insurers. The other is improving data and analytics capabilities. The two technologies complement each other and provide insurers with far greater understanding of their customers.

European insurers have set the pace in rolling out telematics solutions – 19 percent of them already have these products on the market, compared with 16 percent elsewhere in the world. In the other main IoT markets they are in step with insurers in the rest of the world; 17 percent have launched connected home solutions, 14 percent have wearable healthcare products on the market and 10 percent are offering driverless car services.

Insurers that are slow to embrace the IoT risk falling behind their competitors. And many of them will struggle to catch up. It requires considerable time and investment to implement new business models that realize the potential of the IoT. Their value proposition is often highly complex and frequently impacts a wide range of business functions such as pricing, customer relations, business partnerships and product development.

Carriers need to move swiftly and define a clear strategy for exploiting the IoT. They must select a robust operating model that enables them to offer customers an appealing suite of connected products and services. Strategic partnerships and shared ecosystems will be vital.

In my next blog I’ll discuss how insurers are harnessing digital technology to put customers at the heart of their distribution networks.

For more information about Accenture’s 2015 Distribution and Agency Management Survey follow this link: www.accenture.com/InsuranceDistributionSurvey