Other parts of this series:

“Our customers are the most important part of our business,” is a frequent refrain in the insurance industry. However, the systems and processes used to serve these consumers often tell a different story. Traditional sales and distribution systems were built to deliver efficiency and productivity with predefined channel options. And customers usually have to comply with the requirements of their insurer.

Now the situation is changing – and changing fast.

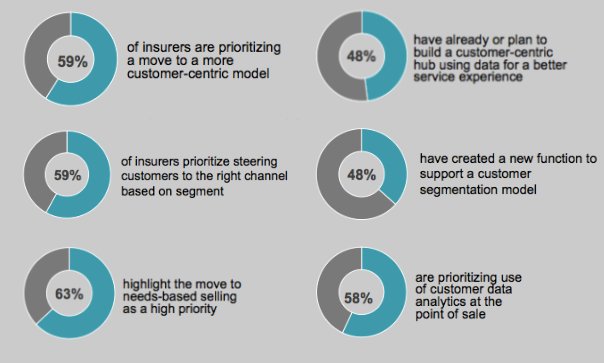

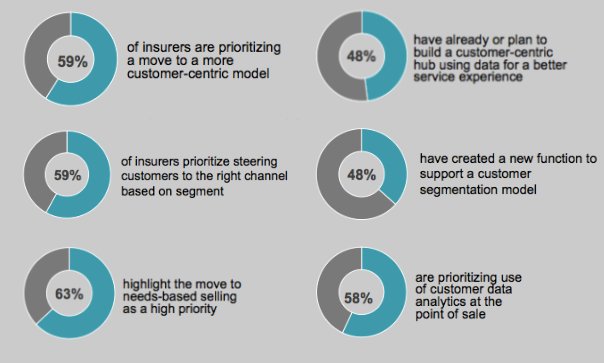

The rise of the digital economy is thrusting the customer into the centre of insurers’ distribution models: indeed 60 percent of insurers are prioritizing a shift to a more customer-centric distribution model, according to our global Distribution and Agency Management Survey.

As part of their increased focus on customer segmentation, 63% of insurers make moving to a more client centric, needs based selling approach a high priority for their future distribution and sales approach.

In addition, 48 percent have or plan to set up a customer-centric data hub to improve the service they deliver and a similar proportion are creating new functions to support their customer segmentation models.

As you can see below, insurers are also recognizing that digital distribution channels must form part of a broader omnichannel strategy.

This focus on omnichannel is essential. During the next three years around 30 percent of digital sales leads are expected to be finalized by an agent over the phone or by a call center operator. About 27 percent of digital sales leads are likely to be concluded by agents in face-to-face discussions with customers. Consumers throughout the world tend to be hybrids; they want multiple options and they prefer to use different channels for different types of interaction with their providers.

European insurers are in step with these global trends. Accident and health insurance, in particular, will use a high proportion of agents and call center operators to conclude a digital sales lead. As much as 40 percent of such leads are currently concluded by agents in face-to-face meetings with customers, for example, although this is expected to dip slightly in the next three years.

The technologies needed to put customers at the heart of insurers’ sales and distribution activities are now available. The race is on to see which carriers can leverage these technologies faster to adapt their sales and customer facing tools and processes to put their customers at the forefront of their businesses.

In my next blog I’ll discuss how digital transformation is forcing insurers to look at new roles for their sales agents.

For more information about Accenture’s 2015 Distribution and Agency Management Survey follow this link: www.accenture.com/InsuranceDistributionSurvey