How to sell life insurance the easy way. Must watch! Learn more: https://www.lisacademy.com If you would like more information on life insurance training and …

How to sell life insurance the easy way. Must watch! Learn more: https://www.lisacademy.com If you would like more information on life insurance training and …

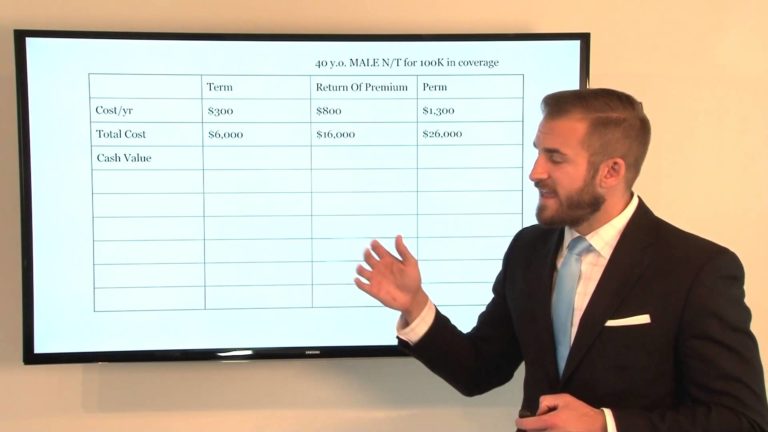

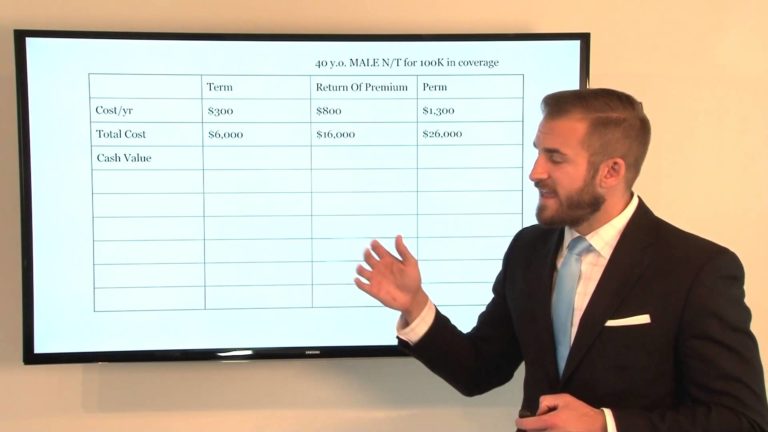

Holy…wow…snake! Very misleading. Take the 20 year Term, invest the separate $1000/yr into the market avg. 8-9% the "cash value" or "equity" is almost doubled from the Permanent. Most insurers guarantee insurability to age 75 without having to requalify for the coverage. And if they were to not renew the term and leave the money there for 20 years without adding anything more per year by the time they're 80 the "cash value" or "equity" would be closer to $280k. Pick up a TVM calculator and run the numbers yourself.?

Good video, its appreciated.?

It isn't a question of which type of life insurance they would buy. It's a question of why they would buy a life policy from YOU and not from someone else.?

Most insurance agents have bad cut suits and shinny cars , you are not a lawyer or health professional.Get your lawyer to go over any policy , this guy is a sales person ,?

Thanks for the video. Good points, ideas and tips. …My comment on financially well educated people whose everyday life is made of finances, investments etc. This was a reply to a comment below, but thought I put it also here to make some points more visible to anyone who watches this video. …Most of the people who analyze universal life plans look at investment and investing from a perspective that not many people have and can't even comprehend. Ones one has spent 10 or 20 years in the industry can easily say this is good, this is not, there are much better things to invest in. Say – real estate – one of the best (if not THE best). OK, now how many people are prepared to take something like that on themselves? How many everyday people are willing to deal with all complications that buying, renting, managing a number of apartments takes? How many people are willing and ready to deal with non paying tenants, or how many are ready to do thorough background checks of their potential tenants etc.? Magazine or web articles about investments written by financially well educated people remind me of when a guy wants to buy a Honda Civic and then a car dealership owner, who never pays the market price for his make of the car to get fixed, washed etc. says to you, oh man, why would you ever buy a Civic!?? If you want a great car, buy a BMW, or Infinity at least! See, lots of people don't even think of buying a BMW and are perfectly happy with their Civics. Civics are reliable cars and can go forever. You don't buy them for off-roading or construction or to pull oversized loads. They can take you from A to B comfortably enough and you can count on them. You know there are better cars, and more comfortable cars, but Civics can even outlive you and you can leave it to your children (making a parallel to the estate and life ins. amount). And they're easy to fix and don't cost a lot to repair. So that's how people who know ins and outs of every investment and insurance plan should look at this issue. Not everyone is a "go getter" and most of people will be satisfied with working until they're retired and then get a decent pension, which won't take them to the moon, but they'll have enough to live a decent life. Mortgages are normally gone by that time and older people don't usually need too much money. Those investments and return rates will most likely perform higher than inflation, the money will be tax free, unlike RRSP , and will be better than TFSA, because of the % you get back from the fund that is being automatically re-invested. Once you die, it will be much easier for you family to sort the things out than if you went through mutual funds, for example. And if you get critically ill, you are entitled to 50% of the policy value, which is a lot of help (unless a crappy agent screwed you over and said that 100k is enough), and your $$ is protected by Assuris (that's at least how things are in Canada. US has much weaker protection and often no guarantees. Before, I didn't know anything about investing or sheltered investments, or real estate etc. I'm getting more into everything every single day and seeing new options and horizons. However, I can't see that almost anyone around me is realizing those same opportunities and they're continuing to watch the American Idol, the Voice, Dancing with the Stars, they listen to the radio on their commute. So now you expect all of them to do something and start researching investments and make better decisions. They'll be happy once they see that they are getting some additional money when they retire and that not many around them enjoy retirement supplements. Don't shoot the guy. Don't shoot the presenter of this video. Those plans can be very good and can e.g. also include mortgage, so you can have 5-in-1, and that's what people prefer, to have everything done at one place. Convenience is the word. That's how people choose their jobs, homes, banks, doctors, food etc. I'm not saying it's great. It's just better than staying at home, not doing anything. You have someone who "brings you the food" of a more nutritive value than if you ordered a delivery. It won't be all organic and made by chef Ramsey, but you'll get needed nutrients and you'll feel much better. …Just drawing a parallel with this example. If people only focus on the price, they go, I'll take term. And after the term is done, they have no cash value and, even if they were never after the cash value, what is more important or scary – they are 10 or 20 years older. Try buying insurance then and check the price. It will hurt. And in case you're e.g. over 70 and have a medical condition (which is very likely in today's world/lifestyle) no one will insure you. Would you agree that if it were not for some of those policies, many people would have zero left to their families, and would have almost zero for their medications and would have to look for employment at the age of 70 etc.? I understand that some agents will sell someone 100k policy that might also get underfunded, but our agent really took time to explain things to us and we were free to bombard her with all possible questions and concerns against this plan, but she didn't want to leave and didn't want us to sing a single paper until she was confident we understand things and are at peace with our decision. She openly asked us how likely is for us to get into the real estate, or how likely will we take financial courses and get into the matter to be able to invest big time and take risks etc. Not everyone is Warren Buffett. With young children and full time jobs (that are not in the financial sector) people don't have time, or are simply not interested in how finances work or find it too complicated to even start thinking about that. If there's a solution/product that can give them 5-in-1 and save them from everyday headaches and help them once they retire, they should have it (provided they can qualify, because not everyone can). That's a more realistic perspective on the issue than the perspective that you or other financially highly educated people see, discuss and write about. The main thing is to find a reliable agent who will sit with you and understand your needs and possibilities, and then make a plan to match your needs. In some cases a cheap term 10 is everything one needs. If one can and wants to have an additional income in retirement, relatively stable investment growth, save for the family, have family covered in case s/he dies, take care of the funeral, have mortgage insurance included in the same product, take a few birds with one stone, they should take universal life like insured retirement plans etc. Please, try to see the world from the perspective of an everyday mortal and try to understand what they need, what they prefer, what's comfortable and convenient for them and what's a total headache.?

Yeah you are right you donot need to sale you just have to make sure that your client need insurance…You are selling peace of mind?

I disliked the video which I often don't do. The video is misleading it says how to sell Life Insurance but it's how to sell permanent policies. I don't like were someone presents an angle on another type of insurance. What's mentioned regarding term is not true and your not giving the client the "REAL" reality. Cash value policies are a weak investment for a growing family. Cash value life insurance policies are good to use to pay estate taxes, and good final expense clients with health issues. There's better things to do with your money. The conversation here is "growing money" that's what is being sold. If you put them in a product with more explosive growth needing money in 20 years is not an issue.

Educate yourself you kidding in today's market?? You shouldn't be sitting on money. It's not a sit on money market right now. Get them making money now alongside the peace of mind you'll have them forever. I'm not saying invest the difference I'm saying making money. You shouldn't be buying money you should be selling it. Everybody is looking to borrow, buy, rent, loan money right now. This is why middle class stays screwed your angling it to make the policy stick and make money. I don't see the benefit as you explain no one wealthy ever got that way "investing" in permanent policies. Honestly I'd convert that presentation all day your not really debunking anything. Your whole debunking theme against term is that the "money goes nowhere", insurability, cost of insurance?

If you were smart about REALLY debunking term you'd do the same thing a term agent would do. HELLO invest the shit somewhere real estate the market anything! Dude let's do something with this money. Let's sell it seriously. Dude at 36 with kids you know what I care about? Making money putting my kid through college and if I die the dream is alive. You seriously need to be kicked in the face swiftly if as a client in 40 years you beat death and get $66,000 and take $20k to go do "something". At 60-70 years old that is the solid savings plan??? Oh yeah by the way Mr. and Mrs. Client if you don't beat death which by the way the statistics on that is higher than people beating death. Say what about the mortgage? Immediate income replacement? I'm not even a captive agent but if this is your strategy no wonder I replace so many of you permanent guys.

Let me kill your presentation now…Hey money guy what happens if I die now? I need $300k but I can't afford that. Well we can policy stack that'll cost you a mercedes benz monthly payment. Well you have to choose living benefit or death benefit. Meanwhile while I'm replacing your policy I'm telling them YOU are the damn living benefit. That other cool dude sold you some swamp land I don't need to sell you something you already have.

On the positive you presentation was a beast I mean seriously. If I'm an idiot who doesn't know better about money I'm buying. That's about 95% of America so makes sense you clocking a six figure salary in the business. All I'm saying is sell it the way you buy it bro I tell my agents don't put a client in something you wouldn't put your family in.?

i sell life insurance too. sell who wants to buy and at the end it's going benefit you and your family. (product)?

I know the purpose of this video is to educate about the different options for life insurance but I have a straight up question: What gives more profit to the agent? sell term or permanent life insurance and why?. Thanks.?

for me Term insurance is a great choice, because if youre financial literate u will use your remaining money in investment. Instead of paying 1300 a year id rather put the 1K in stock market and pay a $300 for term insurance.. its just the same.. this agent didnt mention the state tax that you will be facing when ull getting the cash value..?

curious what actually is the difference between an actuarial from a life insurance agent seems if one is an actuarial he could easily transition to a life insurance agent and visa-versa to some extent??

Great break down! Just sat down with an agent today looking to get a $250k policy and between his break down and yours I'm getting excited about the industry. As a former Naval Officer were used to have term pushed on us without much explanation. Because we had a dangerous job we just thought it made sense. Now a little older and wiser I can see it for family protection and a solid investment vehicle for at least 10% of your portfolio. Also as a sales professional I really love this simple breakdown comparison that truly educates your clients! I may be switching fields!?

So let's say they take the term, and invest the other $1000 per year at 10% rate of return, isn't that going to be much more than the $27 000? You're taking the growth potential away from the client. And if they take the money out, do they get paid both the payout and the cash value? According to my calculations, it would be $63 000. And that's only compounded in 20 yrs, with $1 000 per year. If we go 40 yrs, (client is now 60 yrs old), there would be an investment of $486 851.00. Great rip off. I have a term, and I have my investments. Folks like you, make my job much easier. Thanks!!! I'm referring to this video from now on!!?

I am so sorry for your clients…?

A great example why it is the absolute duty of a true professional Life Agent to Prescribe the BEST INS plan for each client. This presentation is NO different than the Doctor allowing a patient to chose the Drug prescription at the Pharmacy…?

Thank you – very helpful!?

I have a question Lis Academy… What kind n of policy do you have? I bet it's a term policy that covers you till Your 95 yrs. old…. All I got to say Is buy term invest the difference …. Say good bye to Trash value?

Oh…a question…what program did you use to create the presentation? Thanks!?

Whoa. A totally simple process to learn and easily present. Well done sir. Well done. FinalExpenseAdvocates.org?

Sounds like a too good to be true "doing well by doing good" story, but i will try it out, thank you.?