Other parts of this series:

Last week I introduced the findings from a new Accenture survey that examines how P&C, life and multichannel insurers are enhancing their distribution systems to anticipate new customer needs and demands.

With survey participants evenly balanced between these three segments, it’s interesting to see where and how they differ in their approach to agency digitization.

Insurance customers are eagerly adopting digital products, services and channels, in part because of the influence of digital service providers in other industries. But while insurers anticipate a continued shift to digital in most areas of insurance distribution, there is some difference in how committed an insurer is, depending on its specialty.

While life insurers are on track to digitally deliver advice, quotes and sales now and over the next three years, they lag behind the other five types of insurance providers—most notably, accident & health, auto and home insurance providers.

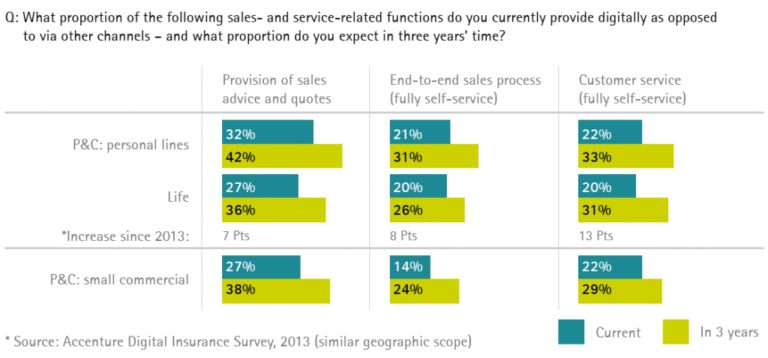

Similarly, while all types of insurers say that digital channels are likely to play an increasing role in the years ahead, differences exist in the types of services provided by each type of carrier, as evident in the chart below:

Accenture Digital and Agency Management Survey

Note that in personal lines, P&C and life are roughly parallel in their provision of sales advice and quotes, end-to-end sales processes, and customer service, with each service predicted to grow over the next three years.

However, there are some critical areas in which life insurance differs dramatically from other types of carriers in terms of digital offerings. I will discuss this in next week’s blog post.

Learn more:

Reimagining Insurance Distribution: Accenture Distribution and Agency Management Survey